Profit-takers moved in after Monday’s gains, which were fuelled by the decision of fiscal hawk Larry Summers to quit the race to become the next Fed chairman.

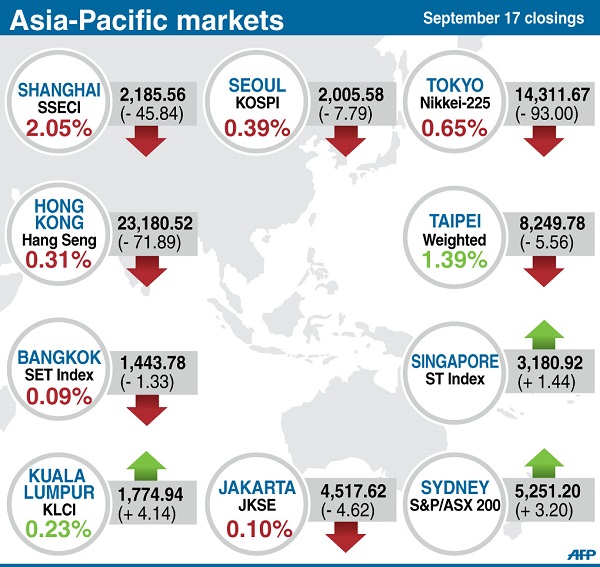

Tokyo gave up early gains to end 0.65 percent lower, slipping 93.00 points to 14,311.67, and Seoul shed 0.39 percent, or 7.79 points, to 2,005.58.

Hong Kong gave up 0.31 percent, or 71.89 points, to finish at 23,180.52. Shanghai slipped 2.05 percent, or 45.84 points, to 2,185.56.

Sydney was almost unchanged, edging up 3.2 points to end at 5,251.2.

With few catalysts to drive buying, the focus is on the two-day Fed meeting that ends Wednesday. While investors expect policymakers to begin winding down the $85 billion-a-month stimulus program, the key question is the pace of the drawdown.

Global shares turned upwards on Monday after Summers withdrew from the running to replace Ben Bernanke as Fed boss.

The former treasury secretary is widely considered a monetary hawk who many feared would have overseen a brisk wind-down of the bank’s bond-buying scheme, which has been credited with fuelling a rally in world markets.

The dollar fell to as low as 98.45 yen on Monday as dealers bet that the stimulus, which floods financial markets with cash, would remain in place longer without Summers in charge. However, it picked up in New York to end the day at 99.11 yen.

In Tokyo on Tuesday it bought 99.20 yen. The euro fetched 132.44 yen and $1.3348 compared with 132.20 yen and $1.3337.

Wall Street cheered the news about Summers, with the Dow finishing 0.77 percent higher and the S&P 500 up 0.57 percent. However, the Nasdaq fell 0.12 percent as Apple suffered another sell-off on disappointment over its latest iPhone models.

Oil prices fell as supply fears receded thanks to a US-Russia deal that may see Syria give up its chemical weapons and avoid an imminent US military strike.

New York’s main contract, West Texas Intermediate for delivery in October, eased 59 cents to $106.00 in afternoon trade. Brent North Sea crude for November slipped 29 cents to $109.78.

Gold was $1,319.11 an ounce at 1039 GMT compared with $1,316.10 late Monday.

In other markets:

— Taipei was flat, edging down 5.56 points to 8,249.78.

Hon Hai Precision fell 0.13 percent to Tw$75.9 while Taiwan Semiconductor Manufacturing Co. was unchanged at Tw$105.5.

— Wellington was also flat, edging up 4.40 points to 4,698.03.

Telecom rose 1.72 percent to NZ$2.36 and Fletcher Building was down 1.55 percent at NZ$9.50.

— Manila rose 0.66 percent, or 41.43 points, to 6,344.14.

Ayala Land rose 2.17 percent to 28.25 pesos, while SM Prime Holdings advanced 2.36 percent to 17.38 pesos. SM Investments fell 1.24 percent to 795 pesos.

— Jakarta ended down 0.10 percent, or 4.62 points, at 4,517.62.

Miner Aneka Tambang rose 0.68 percent to 1,470 rupiah, while cigarette maker Gudang Garam dropped 0.69 percent to 43,000 rupiah.

— Kuala Lumpur gained 0.23 percent, or 4.14 points, to 1774.94.

Malayan Banking added 0.59 percent to 10.18 ringgit while Malaysia Airline System shed 1.54 percent to 0.32 ringgit.

— Singapore ended flat, edging up 0.05 percent, or 1.44 points, to 3,180.92.

Oversea-Chinese Banking Corporation eased 0.88 percent to Sg$10.19 while agribusiness company Wilmar International was down 0.31 percent at Sg$3.22.

— Bangkok also ended flat, slipping 0.09 percent, or 1.33 points, to 1,443.78.

Thai Union Frozen Products jumped 7.00 percent to 53.50 baht, while telecoms company True Corp. lost 3.61 percent to 8.00 baht.

— Mumbai rose 0.31 percent, or 61.56 points, to 19,804.03.

Outsourcer Wipro rose 5.41 percent to 475.35 rupees while rival Tata Consultancy Services gained 2.38 percent to 1,947.05 rupees.—Danny McCord