Buying residential property is usually a well-considered investment decision. We look at whether it’s close to work or school. We think about size, design, number of bedrooms and quality of bathrooms. We think about whether it has a backyard or is near a park or a pool, or in a condo’s case, whether the gym, theaters, parking, etc., suits our standards.

One thing we almost never think about is our home’s vulnerability to catastrophe.

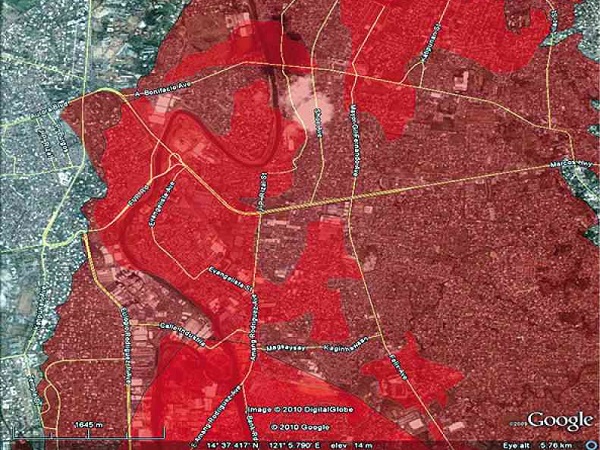

The urban floods of the past few years now make many of us more aware of global climate change and our home’s susceptibility to flood damage. But we also need to consider earthquakes and volcanoes. We do, after all, live along the Pacific Ring of Fire.

What we now know, when it rains, it floods to all levels of society. Posh villages in Makati, as well as residences in the south, were deluged and some roads were impassable for days. People spent the days after the flood mopping up dirty rainwater, and many sustained damage to their property, furniture and vehicles.

Canals, dams

So if you’re buying property now, here are some things to consider. First, check if the area floods. Floods are the greatest source of property damage in Metro Manila this decade. From Tropical Storm “Ondoy” in 2009 to the recent habagat, property insurers paid out billions in claims because of the losses sustained for these events. Check if your area is near a canal or body of water, or if there are dams that can overflow near you. Sometimes, when roads are built or new constructions arise, water finds a different path. Just make sure your property is out of the way.

When it rains, check whether your car is parked in a safe area. While a condo unit has zero chance of flooding, basement parking can be vulnerable. Check out www.floodcarbag.com for a ziplock bag for your car if you live in a flooded area.

Also consider proximity to earthquake fault lines. There is the West Marikina fault line that runs through parts of Quezon City, Pasig, Taguig and Muntinlupa. Ideally, it is relatively safe to live 10 kilometers away from the fault. If the condominium you’re considering is situated near a fault, you should also make sure that it was built on hard soil, and that it complies with the current National Structural Code.

Buildings in Metro Manila built after 2001 are to be designed to withstand a magnitude of 7.0. Properties built on reclaimed lands or on soft soil are also prone to liquefaction during earthquakes.

Lastly, consider that your property is more or less typhoon-proof. In the Philippines, we build our residences and commercial property with concrete, so that we are safe from strong winds. Consider also if there are billboards or towers near your property, as these are susceptible to falling over in case of a typhoon.

And always, remember that an ounce of prevention is worth a pound of cure.

Apparently, there are many insurance companies that can be called in to assess a property’s risks.

Proximity to crisis

Standard Insurance, for example, uses a Catastrophe Risk Management System to check whether a site is prone to flood, typhoons, earthquakes, liquefaction or landslides. Standard Insurance uses their website to check your address versus a series of overlayed Philippine maps to determine proximity to risks. They also assess your property for other safety risks and give advise on how you can protect your assets.

Standard Insurance also advises having properties appraised every few years and insuring for updated amounts. Frequently, people assess the value of their property when they buy it, and don’t update the value for years. As a result, the properties are under-insured, which makes it more difficult to rebuild, in the event of catastrophe. Check www.standardinsuranceonline.com for details.

Buying property is an investment decision that we rarely do. Many of us will only have the good fortune to do this once in our lives. So when considering a property, let’s make sure the site is safe. The weather is kind to the prepared.