MANILA, Philippines–Local stocks climbed back to the 6,000-level on Tuesday as upbeat economic data from China and easing tension over Syria boosted regional markets.

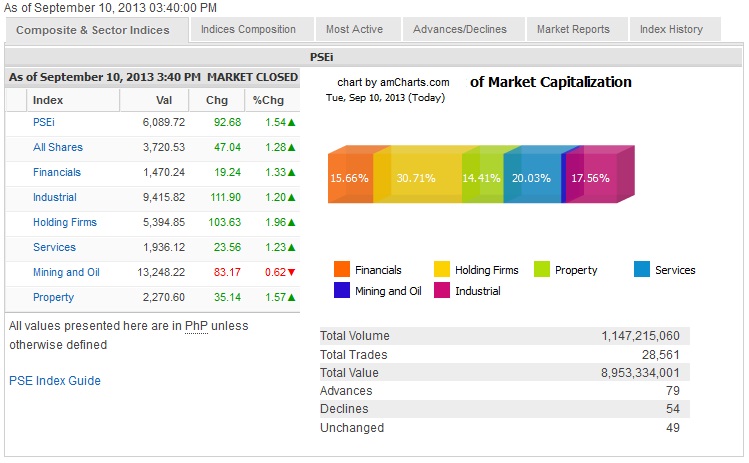

Rising for a third session in a row, the main-share Philippine Stock Exchange index gained 92.68 points or 1.54 percent to close at 6,089.72.

All counters ended over 1 percent higher except for mining/oil (-0.62 percent). In an ongoing mining forum, the industry raised concerns on unfavorable regulations that have soured investor appetite.

Value turnover for the day amounted to P8.95 billion. There were 79 advancers versus 54 decliners while 49 were unchanged.

The biggest index gainers was Bloomberry (+3.77 percent), followed by SMIC, URC, BDO, AC, Metrobank, Globe, Meralco, SM Prime and RLC which all rose by over 2 percent.

China’s factory output rose by 10.4 percent in August, beating expectations and raising optimism on Asia’s second largest economy.

On the other hand, oil prices eased as the US failed to get enough support among allies to launch a military strike against Syria. US President Obama is still trying to persuade Congress to approve a limited strike.

Still at the back of investors’ mind, however, is the anticipation that the US Federal Reserve may announce a reduction in its bond-buying activities when it meets next week.

Meanwhile, the PSE has agreed to lift the trading suspension on Ever Gotesco Resources and Holdings on Wednesday (September 11) at 9 am. This was after the Securities and Exchange Commission lifted its order of suspension on registration and permit to sell securities.