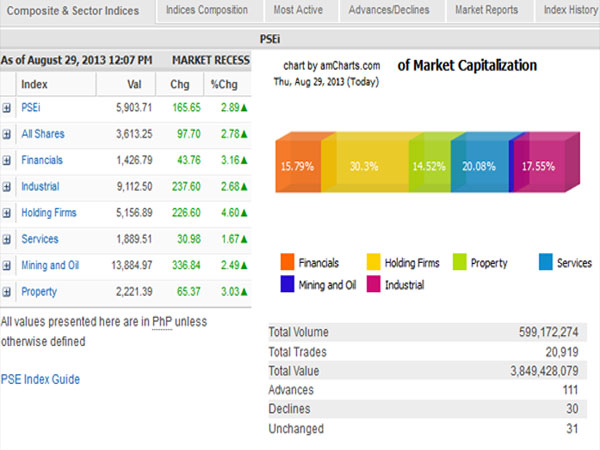

Philippine Stock Exchange index, August 29, 2013. Screengrab from https://www.pse.com.ph/stockMarket/home.html

MANILA, Philippines–Most local stocks rebounded sharply on Thursday as investors took heart from better-than-expected Philippine economic growth and a rebound in regional markets.

The main-share Philippine Stock Exchange regained 165.65 points or 2.89 percent to 5,903.71 in morning trade. The local stock barometer was up by 92.58 points but widened its lead after the government announced that the domestic economy had expanded by 7.5 percent year-on-year in the second quarter, beating consensus forecast of 7.3 percent.

The second quarter growth made the Philippines the best performing economy in Southeast Asia for the period and matched the second quarter pace of expansion earlier reported by China. Although this marked a slowdown from the 7.7 percent revised growth rate in the first quarter, this marked a strong performance even coming from a high base.

A 7.5 percent GDP growth rate on top of 6.3 percent is a “rare feat,” said Bank of the Philippine Islands economist Emilio Neri Jr. The quarter-on-quarter seasonally adjusted growth rate of 1.4 percent was likewise “not bad considering exports are still very weak,” Neri said, adding that the acceleration of capital formation in the second quarter was notable.

All counters surged on Thursday led by the holding firms (+4.6 percent), financials (+3.16 percent) and property (+3.03 percent) sub-indices.

Investors snapped up shares of AEV, Jollibee, BDO, ICTSI, SMIC, RLC, SM Prime, Megaworld, AC and MPIC.

Local stocks have been bludgeoned in the last two days alongside an emerging market shakeout.

Leading online stock brokerage COL Financial, in a research note, said the local markets had fallen because it was found “guilty by association” and not because of any fundamental weakness.

COL Financial head of research April Tan said: “…since the prevailing weakness of our local stock market is brought about by external factors, we are confident that the PSEi will recover faster compared to its Asian peers once risk appetite normalizes and investor sentiment improves.”

“Although we are not recommending investors to buy aggressively, the prevailing correction should be viewed as an opportunity to slowly accumulate stocks at attractive valuations over the next six months,” she said.