MANILA, Philippines — The local stock market went through another day of sell-offs and plunging prices on Wednesday as rising global oil prices triggered by the tension in the Middle East soured global appetite for equities, analysts said.

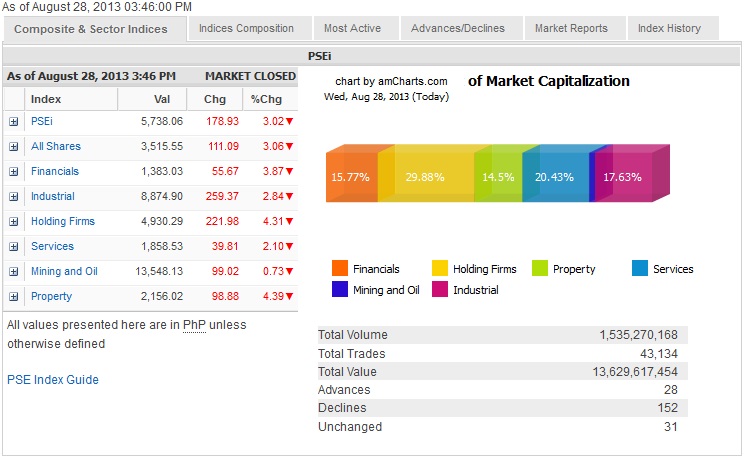

Wiping out all gains for the year, the main-share Philippine Stock Exchange index slumped by another 178.93 points or 3.02 percent to close at 5,738.06. A confluence of external and domestic events—the tension in Syria, risks of US Federal Reserve’s tapering and snowballing concerns among middle-class taxpayers on misuse of public funds—kept the bears in control of the local market.

The local stock index fell by close to 6 percent in early trade but found support at the 5,500 level as the steep fall in the last two days attracted some bargain-hunting.

“The brewing conflict in the Middle East and the spike in oil prices fueled the sell-off. Most markets are down as well. Everyone is racing to the exits,” said fund manager Astro del Castillo of First Grade Finance.

The US and its allies plan to take action against Syria which was accused of using chemical weapons against its people, causing risk aversion across stock markets around the world.

“We believe 5,500 major support can hold based on ‘safety net’ provided by robust Philippine macro fundamentals anchored on strong and sustainable GDP (gross domestic product), low inflation, positive current account, low budget deficit and public debt, etc. — all these coupled with healthy earnings growth will provide solid support for PSEi,” said veteran stock broker Ismael Cruz, president of IGC Securities.

“The sell-off also brings down our valuation levels to a more attractive P/E (price to earnings ratio) of 15x in line with our historic valuation, mind you (at) pre-investment grade” Cruz said.

A P/E ratio of 15x means investors are paying 15 times the amount of money they expect to make in this market for this year.

“It is unfortunate Philippines is being lumped together with other deteriorating ASEAN (Association of Southeast Asian Nations) brothers. It’s now our turn to rise and shine,” Cruz said.

The Philippines government is scheduled to release its second-quarter economic report on Thursday, a performance that is expected to be better than those of other countries in the region. Market consensus points to a 7.3 percent GDP expansion in the second quarter.

“With the 5,500 levels holding and the huge drop there could be some bargain-hunting,” said Banco de Oro Unibank chief strategist Jonathan Ravelas.

The day’s biggest index laggers were SM Investments (-7.45 percent) and EDC (-6.57 percent) while AGI, BDO and SM Prime fell by over 5 percent. ALI, Belle, FGEN, Globe and SMC slipped by over 4 percent.

Meanwhile, domestic concerns are rising over the pork barrel scam in the country and some traders see this affecting the administration’s capability to implement infrastructure programs.

“Local thinking also is that pork (barrel) problem is bigger than we perceive,” Cruz said. “It’s so pervasive. Foreign perception may see this too.”

Originally posted at 12:48 p.m.

Related stories:

PSEi slumps by 4.35% on Tuesday

US builds case for Syria strikes

US stocks sink as West says ready to punish Syria

Asia stocks fall as Syria jitters escalate

Dollar sags in Asia on Syrian tension