MANILA—The local stock market’s barometer firmed up on Friday, tracking a regional rebound after the week’s bloodbath arising from the US Federal Reserve’s anticipated tapering of liquidity measures.

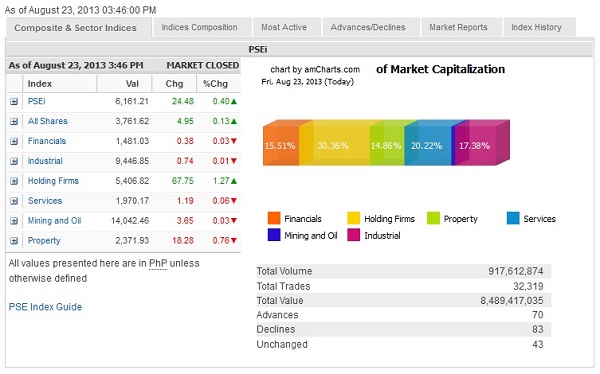

The main-share Philippine Stock Exchange index recouped 24.48 points or 0.4 percent to close at 6,161.21. For the two-day trading week, the index lost 5.6 percent due to Thursday’s massive selldown.

The rebound on Friday was led solely by the holding firm counter (+1.27 percent) as other counters were still in negative territory.

“For every drop, especially since Thursday’s fall was the second biggest drop (for the year), it’s normal to have a rebound after such a sell-off,” said AB Capital Securities head of research Jose Vistan.

“Right now, if you look at the primary trend, the uptrend is still intact but the market may still retest the 6,100 (support),” he said.

As the Philippines is in a relatively better macroeconomic fundamental position compared to other emerging markets in the region, Vistan said, the local market should benefit from such distinction.

Turnover at the local market amounted to P8.5 billion. Despite the slight recovery in the main index, there were still more decliners (83) than advancers (70).

The PSEi stocks that led the day’s rebound were AEV (+5.39 percent), AP (+4.46 percent), DMCI (+3.04 percent), MPI (+2.73 percent), Bloomberry (+2.41 percent), MWC (+1.27 percent) and SM Prime (+1.25 percent).

On the other hand, the day’s laggers were Jollibee (-3.39 percent), Petron (-2.82 percent), and RLC (-2.38 percent) while SMC, ALI, Metrobank and Philex also slipped by over 1 percent.

Thursday’s bloodbath was attributed to pent-up selling pressures arising from the market’s unexpected three-day shutdown during which regional emerging markets were bludgeoned by investment outflows.

Trading at local financial markets was suspended due to massive flooding in Metro Manila last Monday and Tuesday while Wednesday was a non-working holiday (Ninoy Aquino day). While local markets were out of action, there was massive selling across regional markets in anticipation of the start of US Federal Reserve’s tapering of liquidity-inducing bond buying activities starting next month.