Stock market index falls below 6,500 as ‘ghost month’ nears

MANILA, Philippines — Most local stocks slumped on Tuesday, dragging the main index below 6,500, alongside weak trading across regional markets during the last trading day before the so-called “ghost month.”

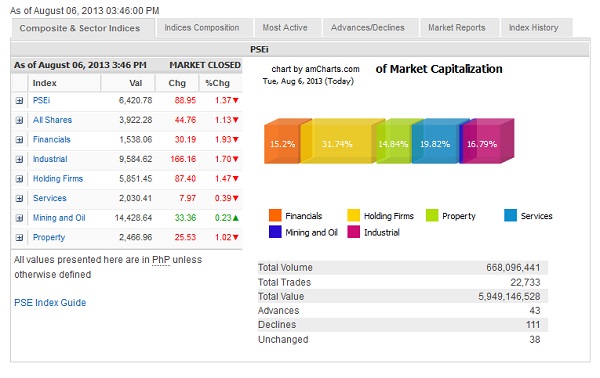

The main-share Philippine Stock Exchange index shed 88.95 points or 1.37 percent to close at 6,420.78, declining for the third session in a row.

Value turnover amounted to P5.95 billion. There were only 43 advancers, which were overwhelmed by 111 decliners, while 38 stocks were unchanged.

The day’s biggest PSEi laggers were AP and MWC, which both slid by over 4 percent while BPI slipped by 3 percent. DMCI, SMIC, URC, RLC, EDC and Philex all plunged by over 2 percent. MPI was likewise down by 1.96 percent.

COL Financial head of research April Lee-Tan said the day’s downturn was in line with the weakness elsewhere in the region.

Article continues after this advertisementIn the short-term, Lee-Tan said the local markets could still suffer from a weaker peso, rising interest rates and volatile financial markets.

Article continues after this advertisement“To combat these risks, investors should adopt a selective approach in buying stocks. Avoid buying stocks that belong to sectors that are expected to deliver weak earnings growth in 2014, have large fund-raising requirements or whose earnings are sensitive to rising interest rates, currency weakness and volatile financial markets,” she said.

The sectors seen to under-perform are the banks, most power companies and airlines.

“Investors should also adopt a staggered approach in buying stocks as the market will most likely continue to move sideways in the next few months given the prevailing concerns,” Lee-Tan added.

Meanwhile, the so-called “ghost month” or the period in the Lunar calendar when some Oriental investors refrain from big-ticket investments or decisions, is set to begin Wednesday (Aug. 7) through Sept. 4. This coincides with the peak of Western summer holidays, resulting in thin trades across major markets.