PSEi down 1.91%

MANILA, Philippines – Most Philippine stocks fell sharply on Friday as a $150-million equity deal by the country’s most valuable company SM Investments dragged down the main index and sapped liquidity in the market.

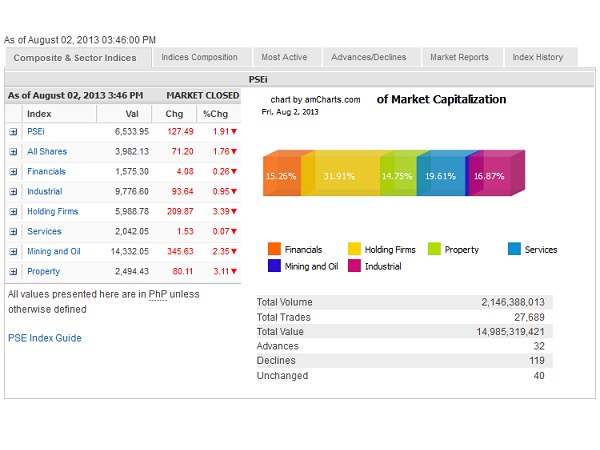

The main-share Philippine Stock Exchange index slumped 127.49 points or 1.91 percent to 6,533.95 while elsewhere in the region, stock markets gained on favorable US economic data.

For the week, the PSEi lost 229.67 points or 3.4 percent.

Analysts said the catalyst for the day was the $150-million equity deal by SM Investments priced at P900 a share, which was a 6.4-percent discount from Thursday’s closing of P961.50.

A stocks analyst from a foreign firm said that apart from the discounted pricing, such new issuances tend to mop up market liquidity, which was already thinning as the “ghost month” was drawing near. Top-up placements also signal to investors that valuations were near the top, the analyst said.

SMIC, the most actively traded stock at the market and the biggest lagger among PSEi stocks, fell 8.58 percent to close at P879. Other big index losers for the day were SM Prime (-5.57 percent) and Bloomberry (-5.24 percent) while ALI, Meralco and AGI all fell more than 3 percent. Philex, Megaworld and SMC slipped more than 2 percent. Semirara was down 1.54 percent.

The day’s PSEi decline was tempered by the gains of PLDT (+1.18 percent) and Metrobank (+0.19 percent).

All counters were in the red but the steepest decline was posted by the holding firms (-3.39 percent) and property (-3.11 percent) sub-indices.

Value turnover swelled to P14.98 billion due to the $150-million equity placement in SMIC. Doris C. Dumlao