Asian stock markets buoyed by Fed statement

BANGKOK — Asian markets rose Thursday after the U.S. Federal Reserve gave no indication it was preparing to wind down a massive bond-buying program that has propelled investors into stocks.

The Fed wrapped up a two-day policy meeting on Wednesday without any changes in its monetary policy that has supported the economy by keeping interest rates ultra-low. That, in turn, has encouraged lending and spending and also boosted stock markets as investors seek returns higher than offered by bonds.

In China, meanwhile, ambiguous data about the country’s powerhouse manufacturing industries did little to dent the mood. The China Federation of Logistics and Purchasing’s manufacturing index released Thursday rose to 50.3 last month from June’s 50.1.

Another survey, however, showed manufacturing at its lowest in 11 months. HSBC’s purchasing managers’ index fell to 47.7 last month from 48.2 in June. Readings below 50 on the 100-point scale indicate a contraction in activity.

The results weren’t shocking, analysts said, as evidence that growth is moderating in the world’s No. 2 economy has been piling up in recent weeks.

Article continues after this advertisement“On balance, today’s number probably didn’t really change … consensus views about the outlook for China,” said Ric Spooner, chief market analyst at CMC Markets in Sydney. “It was a bit of a divided story there, which is why there hasn’t been much of a response at this stage.

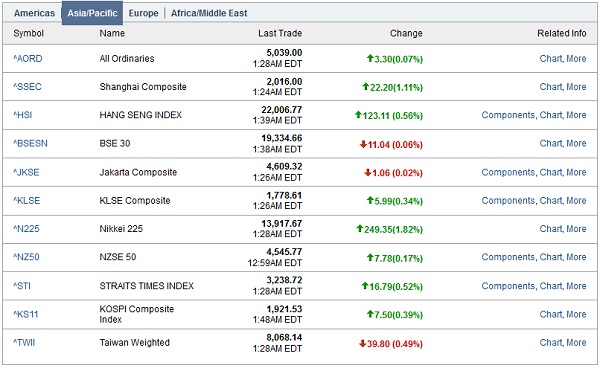

Article continues after this advertisementJapan’s Nikkei 225 index, which has zigzagged all week, gained 2 percent to 13,937.48. Hong Kong’s Hang Seng advanced 0.7 percent to 22,045.36. The Shanghai Composite Index rose 0.9 percent to 2,010.85. South Korea’s Kospi added 0.5 percent to 1,922.56. Australia’s S&P/ASX 200 fell marginally to 5,049.40.

Better-than-expected U.S. growth in the second quarter of 2013 also gave a modest boost to investor morale. The world’s No. 1 economy grew at an annual rate of 1.7 percent, the government said Wednesday, beating expectations of 1 percent for the period. Separately, a private survey from payroll company ADP showed that U.S. businesses created 200,000 jobs this month.

In addition, Eurostat figures showed the number of unemployed across the 17 European Union nations fell for the first time since April 2011, providing further hope for an eventual economic recovery in the region.

Australian banking stocks fell after reports the government plans to introduce an insurance levy on deposits for banks. Details were sketchy but investors shed stocks out of fear that it could affect the bottom line of banks. Australia & New Zealand Banking Group fell 1.5 percent. National Australia Bank lost 1.7 percent.

Panasonic Corp. jumped 5.5 percent, a day after the Japanese consumer electronics giant said its quarterly earnings surged more than eight-fold. Its 107.8 billion yen ($1.1 billion) net profit in April-June was up from net profit of 12.8 billion a year earlier.

On Wednesday, the Dow Jones industrial average slipped 0.1 percent to close at 15,499.54. The Standard & Poor’s 500 index dropped marginally to 1,685.73. The Nasdaq composite index rose 0.3 percent to 3,626.37.

Benchmark crude for August delivery was up 57 cents to $105.61 a barrel in electronic trading on the New York Mercantile Exchange. The contract rose $1.95 to close at $105.03 a barrel on the Nymex on Wednesday.

In currencies, the euro fell to $1.3272 from $1.3299 late Wednesday. The dollar rose to 98.30 yen from 97.75 yen.