BOP surplus rose to $692M in June

Foreign money continued to flow into the Philippines even as short-term investors sold off their holdings of local stocks and bonds following the volatility in global financial markets in June, official data showed Friday.

The Bangko Sentral ng Pilipinas (BSP) reported that the country posted a balance-of-payments (BOP) surplus of $692 million for the month of June, the highest surplus since the $2.04 billion recorded last January.

This came despite the pullout of funds by foreign investors in the later weeks of June amid expectations that the US Federal Reserve would end its easy money policies.

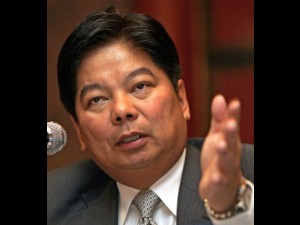

BSP Governor Amando M. Tetangco Jr. said inflows of remittances from overseas Fil ipino workers (OFWs) and revenues from the business process outsourcing (BPO) sector ensured that more money entered the economy than what came out.

The figure for June brought the total surplus for the first half to $2.58 billion, which means the economy is on track to meeting the official projection of a yearend surplus of $4.4 billion.

“Expected sustained inflow from remittances, BPO services and investments back up the full-year projection, which should in turn provide fundamental support for the peso,” Tetangco said in a statement.

Remittances and BPO revenues are two of the country’s biggest sources of foreign exchange income. Money sent home by OFWs is expected to grow 5 percent this year to $22.5 billion. BPO revenues are likewise seen growing to $16 billion this year from $13.5 billion in 2012.

Robust dollar income from both sectors more than offset the repatriation of foreign investors from portfolio holdings in the Philippines.

Latest data showed the Philippines had a net outflow of foreign portfolio investments, which refer to stocks, bonds and government securities, of $22.98 million in June. The net outflow in June was a result of the $397 million that left the country in the second, third and last weeks of June, eating up the inflow of $374 million in the first week of the month.