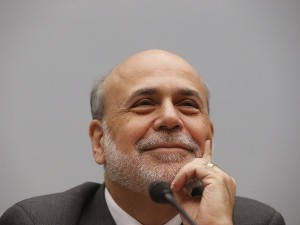

Chairman of the Federal Reserve Ben Bernanke testifies at a House Financial Services Committee hearing on Capitol Hill in Washington, Wednesday, July 17, 2013. AP/CHARLES DHARAPAK

TOKYO – The dollar edged up in Asia on Thursday after US Federal Reserve Chief Ben Bernanke said the bank’s easy money policy would remain in place until it was satisfied the economy was strong enough.

The greenback changed hands at 99.74 yen in the morning, up from 99.60 yen in New York on Wednesday, while the euro fetched $1.3111 and 130.77 yen, against $1.3125 and 130.73 yen.

Bernanke told Congress on Wednesday that the central bank had no firm timetable for cutting back on its bond purchases, and that it would consider reducing its stimulus program only if the economy continues to improve.

“I emphasize that, because our asset purchases depend on economic and financial developments, they are by no means on a preset course,” he told the lawmakers.

He also said the economy was expanding at a moderate pace and showed solid signs of strength in various areas, a view supported by the Fed’s closely followed Beige Book report, which was also released Wednesday.

“Bernanke’s words were nothing new, but did have a calming effect for those still harboring jitters about a near-term end of the U.S. easing policy,” Hiroichi Nishi, general manager of equities at SMBC Nikko Securities.

And Osao Iizuka, head of FX trading at Sumitomo Mitsui Trust Bank, told Dow Jones Newswires: “Since the key event is now out of the way, the market’s focus is shifting to Japan’s upper house election.”

Japanese voters go to the polls on Sunday to elect half of the 242-member upper chamber of parliament.

A clear win for Prime Minister Shinzo Abe’s ruling party could push the dollar up as control of both houses of parliament would enable him to continue unhindered with his big-spending policy measures, Iizuka said.

Eyes will also be on a meeting of the G20 finance ministers and central bank governors in Moscow on Thursday and Friday, which is expected to discuss the Fed stimulus.