Experts see continued volatility in local bourse

MANILA, Philippines—Investors will have to brace for further volatility in Philippine markets this third quarter but an upswing may resume in the last quarter on the back of excess domestic liquidity and good underlying fundamentals, according to a top wealth management officer at Rizal Commercial Banking Corp.

RCBC first senior vice president and wealth management head Manuel Ahyong Jr. said in a press briefing Tuesday that equities would still likely outperform other asset classes this year. Citing his personal view, Ahyong sees the main-share Philippine Stock Exchange index (PSEi) retesting the record highs or at least revisiting the 7,000 levels by the fourth quarter of this year, at the earliest.

His upbeat view, Ahyong said, was anchored on good underlying economic fundamentals alongside strong earnings that corporate Philippines would likely deliver. Property and manufacturing sectors are among those seen continuing to benefit from the economic growth momentum.

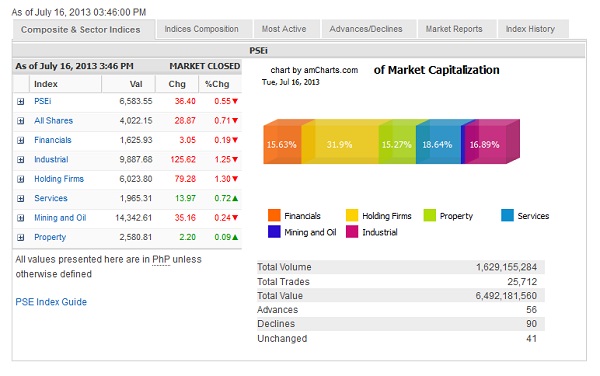

The PSEi peaked this year at around 7,400 in mid-May but fell sharply after as concerns over US monetary policy escalated alongside a string of economic concerns in mainland China.

A fund manager at Philam Life expects the same, saying volatility will remain a key part of investing in the country’s top listed companies as the PSEi “normalizes” and nears its fair value for the year even as long-term prospects remain intact.

However, Eduardo Banaag, Philam Life head of equity fund management, said the benchmark PSEi was not likely to return above 7,000 this year and was seen to end at 6,750, about

16-percent better than its 2012 close, matching the growth in corporate earnings.

That figure, however, is about 9-percent lower than the PSEi’s May 15 record high when it breached 7,400.

Banaag noted that the benchmark measure was unlikely to revisit that level until the middle of next year. For 2014, he said the PSEi could hit the 7,500-level on the back of a 15-percent gain in corporate earnings.

“When there is a lot of volatility, there has to be some degree of irrationality in the market,” Banaag said as he noted that recent movements were driven by normalizing valuations and interest rates.

“It would not have been as volatile if the market was more rational. Maybe, markets were made complacent by too much of a good thing[ such as ] too much liquidity,” he added.

Foreign funds have reacted accordingly, Banaag said, as well as those based in the country, which have been playing a more prominent role in equities investing.

He also pointed to the small size of the local stock market, making it susceptible to sharp upward or downward movements.

Trading volume, meanwhile, has been declining, which Banaag said indicated that investors were “very tentative of the direction of the market.”

Given that the index is nearing their estimate of its fair value, investors would need to look outside the index to achieve higher returns, Banaag said.