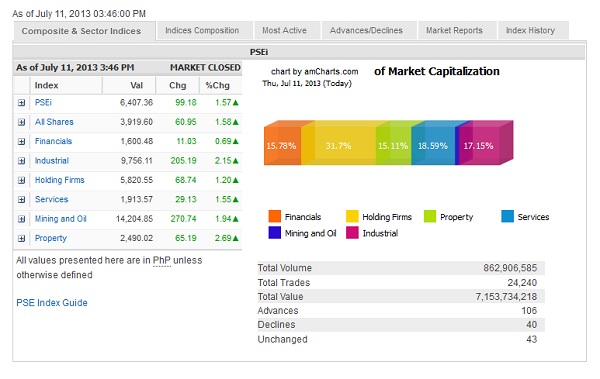

Philippine stocks exchange index as of July 11, 2013, 3:46 PM. Screengrab from https://www.pse.com.ph/

MANILA, Philippines—Local stocks got a big boost on Thursday from a fresh economic growth outlook upgrade by the International Monetary Fund and the US Federal Reserve chair’s talks about the need for sustained monetary stimulus.

The main-share Philippine Stock Exchange index jumped by 99.18 points or 1.57 percent to close at 6,407.36.

All counters rose but the biggest gainers were the industrial and property counters which both rose by over 2 percent.

Value turnover improved to P7.15 billion from the previous day’s.

There were 106 advancers and 40 decliners while 43 stocks were unchanged.

Risk appetite on local equities was boosted by news that the IMF had upgraded anew its growth forecast on the Philippines to 7 percent from 6 percent in contrast with the downgrades on the global economy and other regional peers. The Philippines was seen remaining among the few bright spots in the global economy, with domestic demand fueled by remittances from migrant workers and increased government spending expected to offset the slowdown in the developed world.

The market was also lifted by the strong sentiment in the region. This was as US Fed chair Ben Bernanke delivered a dovish remark amid a raging debate on the tapering of the US central bank’s $85 billion monthly bond-buying operations. Bernanke said that low inflation and high unemployment would prompt the Fed to continue its stimulus.

Only last month, Bernanke’s comment that the US Fed would taper its bond purchases and completely phase out by mid-2014 caused a shakeout in emerging market assets.

The day’s index outperformer was Petron (+7.01 percent), followed by Bloomberry (+5.82 percent). FGEN, ALI and DMCI were all up by over 4 percent while Philex, AC, URC and Megaworld gained over 3 percent. MWC, battered by concerns on consumer complaints against pass-on charges, rebounded by 2.73 percent.