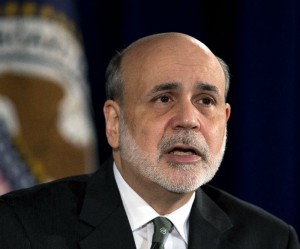

Asian shares up on Ben Bernanke stimulus comments

HONG KONG – Asian markets rallied Thursday after US Federal Reserve boss Ben Bernanke said its stimulus drive would be kept in place “for the foreseeable future”, but Tokyo’s advance was capped as the yen surged against the dollar.

The news poured cold water on expectations the central bank would start to pull back on the massive bond-buying later this year, which has sent global forex and equity markets reeling in recent weeks.

Tokyo rose 0.39 percent, or 55.98 points, to 14,472.58. Stocks’ gains were held back as the greenback, which tumbled below the 100 yen level late Wednesday, fell further on Thursday after the Bank of Japan held off any more stimulus measures.

However, sentiment was supported as the bank gave an upbeat assessment of the economy, using the word “recover” for the first time in two years.

Seoul closed 2.93 percent higher, adding 53.44 points to 1,877.60 and Sydney added 1.31 percent, or 64.3 points, to 4,965.7 and Shanghai was 3.23 percent higher, adding 64.87 points to end at 2,072.99.

In the afternoon Hong Kong jumped 2.36 percent and Shanghai was 3.11 percent higher.

Bernanke on Wednesday insisted the Fed’s easy-money policy was still necessary, because the unemployment at 7.6 percent was still too high and inflation was too low for comfort.

“Both the employment side and the inflation side are saying that we need to be more accommodating,” he said, answering questions after a speech.

“Moreover, the other portion of macroeconomic policy, fiscal policy, is now actually quite restrictive… Put that all together, I think you can only conclude that highly accommodative monetary policy for the foreseeable future is what’s needed in the US economy,” he said.

He added that the full impact of deep government spending cuts put in place in March was yet to be seen.

The comments came hours after minutes from the bank’s latest policy meeting suggested it would move more rapidly toward winding up the $85-billion-a-month stimulus.

Currency dealers immediately sold the dollar, betting that interest rates would remain low for a long time to come. In New York it ended at 99.59 yen, well off the 101.10 yen in Tokyo earlier in the day.

By Thursday afternoon the greenback was trading at 98.87 yen. The euro bought $1.3071 and 129.20 yen against $1.3013 and 129.59 yen.

“Most of the signs that had been telegraphed to the markets had indicated that tapering of the Fed’s easing programme would begin sooner rather than later,” said SMBC Nikko Securities general manager of equities Hiroichi Nishi.

The comment by Bernanke “struck as a shock”, he said.

Adding to the yen’s rise was the BoJ’s decision Thursday not to add to April’s massive bond-buying scheme.

In a statement the central bank said the economy was “starting to recover modestly” with investment, and corporate and consumer confidence lifting.

Gold also climbed as the weaker dollar makes it more attractive as an investment. The precious metal was worth $1,287.95 per ounce at 0650 GMT, compared with $1,253.50 late Wednesday in Asia.

Oil prices were mixed after soaring Wednesday on news that stockpiles had fallen more than expected, indicating a strong pick-up in demand as the economy strengthens.

New York’s main contract, West Texas Intermediate (WTI) light sweet crude for delivery in August, was up 27 cents to $106.79 a barrel and Brent North Sea crude for August was down 13 cents at $108.38.

On Wednesday WTI rose $2.99 while Brent had added 70 cents.

In other markets:

— Taipei rose 2.10 percent, or 167.85 points, to 8,179.54.

Taiwan Semiconductor Manufacturing Co. gained 3.30 percent to Tw$109.5 while Hon Hai Precision was 2.77 percent higher at Tw$78.0.

— Wellington was flat, adding 3.29 points to 4,560.05.

Chorus rose 0.75 percent to NZ$2.67 and Freightways was up 0.97 percent to NZ$4.17 but Fletcher Building was down 1.27 percent at NZ$8.55.