BSP: Cheap credit helped small businesses in ’12

MANILA, Philippines—Small businesses boomed over the last year as entrepreneurs took advantage of access to cheap credit and rising household income levels that were supported by the country’s economic growth, the central bank reported.

Data from the Bangko Sentral ng Pilipinas (BSP) released late Monday showed a healthy increase in savings by microfinance clients, which exceeded loans extended to small enterprises at the end of the first quarter.

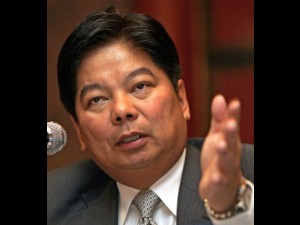

“This is a testimony that the entrepreneurial poor are capable of saving, [which] is contrary to the customary belief that the poor do not save,” BSP Governor Amando M. Tetangco Jr. said.

At the end of March this year, the BSP said microfinance institutions had over one million clients—the highest ever recorded. These clients had total savings of P8.224 billion in the same period, significantly higher than the P6.43 billion at the end of 2012.

Outstanding microfinance loans in the same period totaled P8 billion. While this was lower than the P8.4 billion in outstanding loans reported at the end of last year, this was still significantly higher than the P2.6 billion in 2002.

Article continues after this advertisementMicrofinance lenders used to offer below-market interest rates for borrowers. This proved ineffective in opening up access to financial services for low-income households and businesses.

Article continues after this advertisementA new approach was adopted in 2001, where loans were offered at normal rates. But under the new scheme, banks were allowed to subsidize administrative costs, provisions for loan losses and intermediation fees. At the time, the BSP said, this was consistent with the proposition that “what matters most to the poor and underserved segments is access to financial services rather than interest-rate cost.”

A microfinance loan averages P25,000 a person, but can reach a low of about P2,000 and a high of P150,000, the BSP said.

This approach “enables people to seize economic opportunities,” Tetangco said.