HONG KONG — Stock markets from Sydney to Shanghai extended gains for a second day Thursday after the U.S. said quarterly growth may be weaker than expected, raising investors’ hopes that the Federal Reserve would delay plans to wind down its stimulus program.

Further signs of easing in China’s money markets also helped lift stocks.

Japan’s Nikkei 225 jumped 2.4 percent to 13,142.50 and Hong Kong’s Hang Seng gained 1.3 percent to 20,607.27. South Korea’s Kospi surged 3 percent to 1,837.45.

Australia’s S&P/ASX 200 added 1.8 percent to 4,818.80. Benchmarks in New Zealand, Singapore and Taiwan also rose.

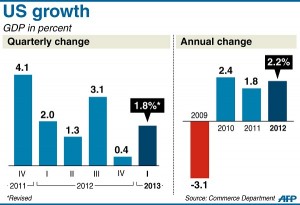

The U.S. government cut its estimate for second-quarter economic growth to 1.8 percent, down sharply from 2.4 percent because of lower than predicted consumer spending.

While news of the weakness in the world’s biggest economy was disappointing, it was also positive for investors, who were rattled last week after Fed Chairman Ben Bernanke said the U.S. central bank would slow its bond-buying program if the U.S. economy continues to strengthen. That program has kept interest rates low and made stocks more attractive.

“This doesn’t put a new spin on the outlook but it certainly makes one wonder all the more about the Fed’s ‘new and improved’ outlook for 2014,” economists at DBS Bank wrote in a commentary.

Mainland Chinese benchmarks opened sharply higher after a report that Chinese industrial profits grew strongly in May, though they pared their gains by midday. The Shanghai Composite Index advanced 0.4 percent to 1,959.25 and the smaller Shenzhen Composite Index rose 0.3 percent to 913.87.

Markets were also buoyed as interbank lending rates in China continue to ease after a pledge earlier in the week by authorities to shore up banks facing cash shortfalls.

“We expect the interbank rates will come down further in the coming weeks,” J.P. Morgan analysts Haibin Zhu, Grace Ng and Lu Jiang said in a research report. But they said that they didn’t expect the rates to fall to the level they were at previously.

The central bank had allowed rates that banks pay to borrow from each other to soar last week, part of an attempt by Beijing to clamp down on massive credit in the informal lending industry.

Fears of a credit crisis in the world’s second-biggest economy had contributed to a rout in global markets that ended when policymakers in China softened their stance with the promise to provide “liquidity support” if needed.

Benchmark oil for August delivery was up 39 cents to $95.89 a barrel in electronic trading on the New York Mercantile Exchange. The contract rose 18 cents to end at $95.50 a barrel on Wednesday.

In currencies, the euro rose to $1.3031 from $1.3012 late Wednesday in New York. The dollar rose to 97.76 yen from 97.74 yen.