The local stock index on Wednesday dipped as regional markets awaited the next move of the US Federal Reserve.

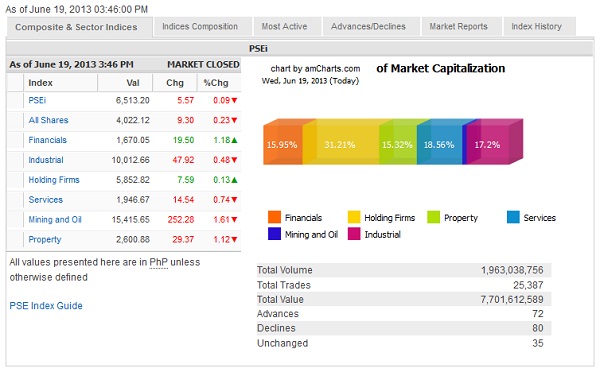

The main-share Philippine Stock Exchange index shed 5.57 points, or 0.09 percent, to close at 6,513.20.

Mining/oil and property counters saw the steepest drop of the day, both falling by over 1 percent.

On the other hand, the day’s losses were tempered by the rise of the financial and holding firm counters.

Value turnover on Wednesday amounted to P7.7 billion, weaker than the average P10 billion in daily turnover seen earlier this year.

There were 80 decliners against 72 advancers, while 35 stocks were unchanged.

The biggest index decliners were AEV (-3.35 percent) and Philex (-3.24 percent). ALI likewise went down by 2.3 percent.

SM Prime, EDC, AP and Globe Telecom all slipped by over 1 percent.

PLDT, Bloomberry and Meralco also contributed to the PSEi’s decline.

On the other hand, AGI (+3.4 percent) was the day’s top performer, while Megaworld, BDO and BPI all gained by over 2 percent. Metrobank, RLC, DMCI, SMC all rose by over 4 percent. Jollibee and MPI also gained.

Across the region, all eyes are on the two-day Federal Open Market Committee Meeting, where investors hope to find clues on how soon the US Fed would scale back its bond buyback programs that have served to boost emerging market assets in recent years. Doris C. Dumlao

Originally posted at 06:05 pm | Wednesday, June 19, 2013