MANILA, Philippines—The local stock barometer surged sharply on Tuesday, retesting the 6,500 level albeit in thin trade, as the recent depreciation of the peso was seen boosting local consumer spending and corporate profits.

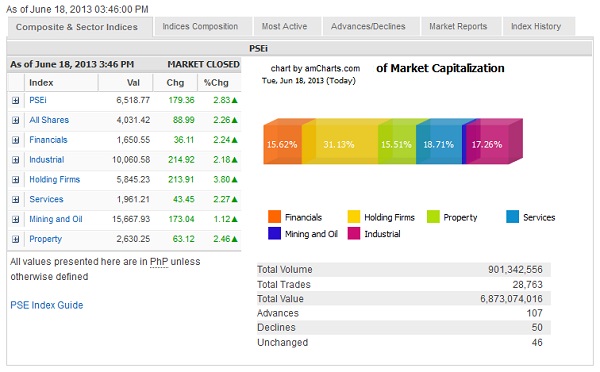

The main-share Philippine Stock Exchange index added 179.36 points or 2.83 percent to close at 6,518.77, rebounding for the third session after a sharp pullback seen last week.

This was even as trading across the region was choppy ahead of a closely-watched US Federal Reserve Open Market Committee meeting. Investors are keenly waiting for clues on how soon the US Fed would start scaling back on its liquidity-inducing bond buyback programs that have boosted global markets.

Joseph Roxas, president of local stock brokerage Eagle Equities, suggested that the day’s rally was because investors were again focusing on fundamentals after last week’s panic. As the Philippines is enjoying better economic fundamentals, the recent decline was seen as an opportunity to reenter the market.

Roxas added that consumer play would be strong this year, especially with the peso’s depreciation against the US dollar. He said this meant “additional P60 billion (in prospective consumer spending) because of the peso depreciation.”

Overseas Filipinos remit about $2 billion a month to the country, thereby boosting domestic spending.

Value turnover was thin at P6.87 billion. There were 107 advancers that overwhelmed 50 decliners while 46 stocks were unchanged.