US credit slip more boon than bane to Filipinos

What does the unprecedented credit downgrade of the United States mean for the average Filipino? Economic and finance experts are agreed that Filipinos are not that vulnerable, although they also said fund managers, exporters and beneficiaries of overseas workers’ remittances could feel some pain.

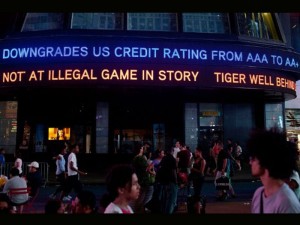

The US last week for the first time lost its sterling credit rating with the Standard and Poor’s credit rating agency, which downgraded its topnotch triple A credit rating—which it had held since 1941—to AA+.

According to economists and financial experts, led by Socioeconomic Planning Secretary Cayetano W. Paderanga Jr., the Philippine economy is “stronger” now than it was during previous global financial shocks.

Benjamin Diokno, a former budget secretary who now teaches economics at the University of the Philippines, said the US economy will grow at a slower rate for many years to come and that would be “bad news” for the Philippines in terms of lower exports, lower remittances and lower foreign direct investments (FDI).

According to Paderanga, however, the Philippines is well-positioned for opportunities.

Article continues after this advertisement“Fiscal issues are no longer present. Access to financial markets are much better. Government reforms have led to much higher confidence,” he said in a text message.

Article continues after this advertisementFew Filipinos play in stocks

Moreover, with the US Federal Reserve assuring that there will be minimal interest rates over the next two years and the local central bank, Bangko Sentral ng Pilipinas, having recourse to various foreign exchange control mechanisms to prevent the peso from becoming “too strong,” the current situation even presents some opportunities, especially for those with savings, the experts said.

Very few Filipinos play in stocks or foreign currencies anyway and most would rather save money in banks or venture into small businesses, the economists said.

And, according to finance experts, it would seem that the US credit downgrade was not inflationary, that is, the prices of food, fuel and basic commodities should remain stable.

Oil prices may even go down due to lower demand from a weak US economy, they said.

“There could be minimal effect from the average Filipinos’ day-to-day standpoint, especially those who have monthly income from salaries and have savings,” said Eduardo V. Francisco, president of BDO Capital and Investment Corp.

Francisco did note that lower export earnings could result in labor cuts among export companies which could affect allied industries.

He said the government should invest in job-generating projects such as infrastructure and should make it easier to do business in the Philippines to improve employment prospects for the average Filipino.

Resilient OFWs

While the peso may strengthen, which would affect the buying power of remittance beneficiaries, the experts said overseas Filipino workers (OFWs) normally cut down on their own spending abroad to maintain or even increase the amount of remittances needed to sustain their dependents’ way of life.

“Let’s pray our OFWs do not get displaced. One good example is shipping. Lots of Caucasians lost jobs in crises before but Filipino seamen kept theirs and even got promoted because they were more flexible,” Francisco said.

It helps that Filipino workers are valued for their hardworking, people-oriented and cheerful nature, the experts said.

“Most of our OFWs are in sectors which are not easily affected by shocks in the capital markets. In the past, such as the 2008/2009 financial crisis, remittances were expected to go down but they in fact increased,” said Arsenio M. Balisacan, dean of the University of the Philippines School of Economics.

Oil prices are likely to remain stable or even go down with weaker demand in the US, which means the cost of living in the Philippines should remain stable in the near term.

Salaried workers, etc.

“For a salaried person with savings but no investment the downgrade will have an indirect impact through interest rates and the potential effect on the overall economy,” said Cid L. Terosa, economics professor at the University of Asia and the Pacific.

Loans for startups might tighten as banks manage risks, Francisco said. But companies with good credit records should have banks wooing them and not the other way around, he said.

However, if the effects of the US downgrade prove worse than expected throughout the world and results in a sluggish economic activity for the Philippines, even potential home owners and business loan borrowers could later be affected by inflation and higher loan rates, Terosa said.

Pensioners and the insured

Retirees who rely on their pension plans and those with insurance policies are also expected to be generally unaffected as long as they remain frugal and do not suddenly ramp up their spending.

“The value of pensions will not materially change,” Francisco said.

Pensioners of the state-run Social Security System (SSS) and the Government Service Insurance System (GSIS) have nothing to worry about, said Astro C. del Castillo, managing director of the First Grade Holdings brokerage firm.

“These are well-established institutions,” he said.

The experts noted that insurance companies mainly invest their funds in the country, and are thus less vulnerable to outside shocks.

While those with insurance-linked income may need to wait longer to realize returns, there is no cause for concern as the industry has learned from previous mistakes, the experts said.

‘Hot money’ vs FDI

With the US credit downgrade, there is less investor confidence in the US economy, the experts said.

Investors will be looking for “safe havens” for their investments, away from the US, and into the emerging markets, which led global growth last year and are expected to perform well again this year, they said.

However, the experts said “hot money,” or foreign investments in stocks and bonds, would not really help the Philippines since this is the kind of capital that can be withdrawn anytime.

They said the Aquino government should work at attracting long-term, direct investments in terms of companies investing in infrastructure or opening offices, research facilities and such.

Infrastructure now

The economists and financial experts agreed that for the government and for investors awash with cash, now is the time to invest, especially in job-generating infrastructure.

“The point is how can we attract long-term investments from both foreigners and locals? PPPs (public-private partnerships) have been slow going,” Balisacan said.

Balisacan credited the Aquino government for striving to change the perception that the Philippines is a country riddled by corruption.

Blessing in disguise if…

But he said investments should be made in infrastructure and the government has to show that contracts will be honored, that the rules on investments will not change in the middle of the game.

“The economic turmoil could be a blessing in disguise if we can pump-prime our economy now and if we can convert savings into equity. Otherwise, there will be a wait-and-see attitude and this is not good because there are other countries where it is cheaper to invest for foreigners,” Balisacan said.

The current favorites are Indonesia, Vietnam and India. China is getting to be too expensive although the large size of the market still makes it attractive for investors, he said.

“We have learned much from 2008/2009 so unless the global crisis this time around becomes much bigger, to the point that even fast-growing economies in Asia get hit, we can turn this to our advantage,” Balisacan said.

Earlier this week, the country’s economic managers told a Senate hearing that the Philippines may not be adversely affected by the US credit downgrade, especially over the long term.

For all their assurances, however, they hedged their bets, asking for more time to assess the situation, according to Senator Franklin Drilon, the chair of the finance committee.

The senators also reportedly questioned the Aquino economic officials on the seemingly slow pace in public spending, especially on job-generating infrastructure projects.

The government has kept a “fighting target” of 7- to 8-percent gross domestic product growth from 2011 to 2016.