The government will have to reduce its 2013 target revenue from import duties and taxes due to the unexpected slump in imports which, in turn, has taken its toll on the collections of the Bureau of Customs (BOC).

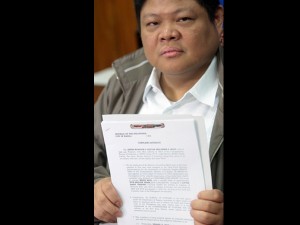

According to Customs Deputy Commissioner Peter Manzano, the BOC expects the Development Budget Coordination Committee (DBCC) of the government to announce in July a reduced collection goal for the agency.

The BOC was originally tasked to collect P397 billion in import taxes and duties in 2013. But the DBCC, the interagency body that sets economic targets, earlier this year reduced the figure to P340 billion, citing the initial data on imports, Manzano said.

An even steeper decline in imports reported recently had prompted the DBCC to review the economic goals anew. Manzano said this development could lead to another reduction in the BOC’s revenue target.

“Findings by the Neda (National Economic and Development Authority) and DTI (Department of Trade and Industry) show that imports indeed have fallen significantly, and are likely to miss earlier growth projections,” Manzano told the Inquirer.

Imports were originally expected to grow by at least 10 percent this year. However, the continuing crisis in the euro zone and a weakened US economy have dampened global demand, affecting export revenues of the Philippines and other countries. This development forced most exporters to reduce the importation of capital goods and raw materials needed for manufacturing.

The National Statistics Office earlier reported that the Philippines’ merchandise imports fell year-on-year by 7.4 percent to $14.36 billion in the first quarter.

Although the BOC may miss its original collection target for 2013, it will still work on improving its actual take in 2012, Manzano said.

The BOC last year collected P289.87 billion in duties and taxes.

Manzano, who also heads the BOC’s Run After the Smugglers (RATS) program, said the BOC would go after more tax cheats to recover lost revenue and discourage smuggling.

Yesterday, the BOC reported that two trading firms, Little Giant Trading Co. and All System Logistics Inc., were accused of trying to slip into the country rice from Taiwan and Vietnam without paying taxes and duties.

Complaints have already been filed with the Department of Justice, the BOC said, referring to the suspected cases of attempted smuggling.

A total of 133 cases have now been filed by the BOC under the RATS program.