WASHINGTON—The US trade deficit grew in April as consumers snapped up imported goods such as cellphones, televisions and clothing, official data showed Tuesday.

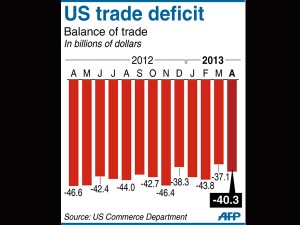

The trade gap widened to $40.3 billion in April from a downwardly revised $37.1 billion in March, the Commerce Department said.

A surge in imports, up 2.4 percent from the prior month at $227.7 billion, was twice as strong as the rise in exports to $187.4 billion.

Still, the trend of a narrowing deficit remained intact as the global economy slows under the impact of recession in Europe.

The shortfall “remains within the range of the declining trend since early 2012, when imports peaked,” said Chris Low of FTN Financial.

“As a result, the trade deficit is likely to continue shrinking in Q2, contributing to GDP.”

Year on year, the deficit fell 13.5 percent in April. The three-month moving average was $40.4 billion, down from $41.2 billion in the three months ending in March.

The trade numbers reflected rising domestic demand in the world’s largest economy as the embattled job market slowly improves and the housing market recovers with help from massive Federal Reserve support.

“The economy is improving so it should surprise no one that we are importing more and the trade deficit is widening,” said Joel Naroff of Naroff Economic Advisors.

Consumers, who power most of the US economic activity, showed an increasing appetite for foreign goods.

Consumer goods led imports, advancing 7.2 percent to $44.3 billion, including a 12.3 percent jump in mobile phones.

Imports of automobiles and parts also were strong, climbing 5.3 percent to $25.5 billion.

Imports of petroleum products, which account for more than 10 percent of all US imports, slipped slightly to $29.6 billion, the lowest level since November 2010.

Export growth slowed, although exports of consumer goods and motor vehicles hit record levels, the department said.

Trade gap with China soars

The politically sensitive trade gap with China soared 34.6 percent, to $24.1 billion in April from $17.9 billion in March.

President Barack Obama’s administration long has pressed China to allow the country’s currency to appreciate. Critics say that Beijing keeps the yuan, or renminbi, undervalued to make Chinese exports cheap to gain an unfair trade advantage.

News of the wider trade gap with China came ahead of Obama’s two-day informal summit with Chinese President Xi Jinping that begins Friday in California.

“I’m not confident that this issue will really be on the table,” said Scott Paul, president of the Alliance for American Manufacturing.

“It’s difficult to forge a true partnership with such an imbalanced economic relationship.”

On Monday Paul sent a letter to Obama urging the president to get tough with China, saying: “Americans are losing patience with China’s refusal to play by the rules.”

The manufacturing lobby chief also pointed to the widening of the trade deficit against Japan, up 5.9 percent to $6.9 billion.

“That is a direct consequence of the ‘green light’ that the Treasury Department gave to Japan to dramatically lower the value of the yen. There is no greater threat to the health of our domestic auto sector and the jobs it provides at this time,” the organization said.

The US trade deficit with the European Union also widened sharply, to $12.4 billion and, with the recession-gripped eurozone, to $10.0 billion.

The deficit with Canada, the top US trade partner, edged up to $2.4 billion, while the gap with Mexico dropped 16 percent to $4.4 billion.—Veronica Smith