Long way for PH coffee brew to go global

The champions of local coffee in the government and private sector still have a lot of work to do before Philippine coffee can become a regular fixture in the world’s coffee chains.

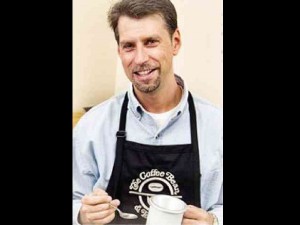

According to Jay Isais, the US-based coffee expert of Coffee Bean and Tea Leaf, global chains have so far “not seriously considered Philippine coffee as a viable product” due to factors such as concerns about the quality as well as lack of knowledge in large coffee markets that the Philippines can be a good source of coffee beans.

Isais says, however, that there are great profit opportunities that the Philippine coffee sector can take advantage of, adding that the global coffee sector is always on the lookout for new varieties to offer customers.

“We do limited edition products all the time and we’re looking for them constantly,” says Isais, who was in the Philippines recently as part of the training program of the local Coffee Bean and Tea Leaf chain.

“We have a dual purpose, we support the coffee farmers and the coffee farming ingredients and we also support areas and markets where we have franchise stores. But if we can do both simultaneously, it’ll be better because we’re not just promoting our Philippine stores and partners but we are supporting Philippine coffee industry as well,” he adds.

The local coffee sector is estimated by the Philippine Coffee Board Inc., a nongovernment organization leading efforts to revitalize the local coffee sector, to be worth P40 billion, employing about 70,000 farmers in 22 provinces.

Total Philippine production of about 25,000 metric tons a year, however, is not enough to meet the demand of about 100,000 metric tons a year, forcing traders and manufacturers to import about 75,000 tons a year, mainly from Vietnam and Indonesia.

The PCB and the National Competitiveness Council are working together to draft a roadmap to increase the competitiveness of the Philippines in the coffee world, and make the Philippines a net coffee exporter again in about 10 to 15 years.

For the Philippines to join the ranks of countries such as Brazil, Indonesia, Vietnam, Colombia, which are known worldwide for their coffee, Isais recommends that Philippine producers be consistent in the quality of their coffee and that more investments also be poured into the processing of the beans.

Coffee Bean and Tea Leaf, which is celebrating its 50th year in the business, sources the bulk of its beans from Central and South America. Indonesia is its only source of coffee in Southeast Asia. In Asia, other sources are India and Nepal.

The Philippines has the potential to be included in the list of suppliers, but Isais stresses that the Philippines has to “demonstrate that it can produce quality coffee.”

“If you can establish that there’s a flavor and character for the Philippine coffee that doesn’t exist elsewhere, the consumer will flock and love your product. For coffee buyers around the world, what we first look into is the character of the coffee. In the coffee world, there’s so much gimmick but what really matters is the substance and character of the coffee. You will survive throughout because people are continuously looking for some unique special thing that has underlying qualities,” he adds.

Isais also says that it was a good time to invest big money in the coffee industry, as the demand for the world’s most popular beverage is not about to wane.

“Coffee will be fine in 2013. We have big plans for the year,” says Isais.