Ayala commits P13.3 B for power projects

MANILA, Philippines—AC Energy Holdings Inc. has already committed $325 million (or roughly P13.3 billion) in equity investments for four power projects, out of its planned $700-million capital outlay for the energy sector over the next five years.

In a briefing following Ayala Corp.’s stockholders’ meeting on Friday, AC Energy president Eric T. Francia said the $325 million had been earmarked for previous interest acquisitions in energy firms and for upcoming power projects.

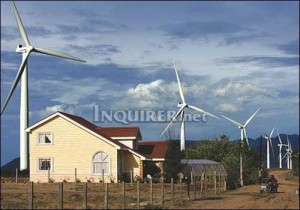

This included a $20-million investment for a 50-percent stake in NorthWind Power Development Corp., which currently owns and operates the country’s first and only wind project—the 33-megawatt Bangui wind farm— $155 million for a 20 percent stake in GNPower, which is commissioning this year a 600-MW coal plant in Bataan; $90 million for the construction of two 135-MW coal units in Batangas in partnership with Trans-Asia Oil and Energy DEvelopment Corp.; and $50 million for a mini-hydropower project in North Luzon.

According to Francia, the $700 million to be spent on power related opportunities will allow the Ayala group to meet its target power portfolio of 1,000-MW gross capacity, of which half would be attributable to the company.

“We have committed equity capital of over $300 million on projects that are real already. We do have pipeline of projects to fill up the $600 million to $700 million [planned capital spending],” Francia said during the stockholders’ briefing Friday.

“Our strategy of record for AC Energy is to have a combination of conventional (or fossil-fuel) and renewable energy resources. Given the realities, the need for the country to have baseload and relatively competitively-priced power, we see the mix [of our power portfolio] tipping towards conventional energy (such as coal). We will deploy 70 percent of equity capital in the first five years to conventional sources and 30 percent on renewable energy sources,” Francia explained.

“Over time, we will have a more balanced mix and more of renewable energy although we believe it will take us some time to get there,” he added.

For this year, the Ayala group is targeting to spend some to $200 million to fund its equity portion in several key power projects.