Asian markets mostly up on China data

Wall Street also provided a strong lead ahead of the January-March corporate earnings season.

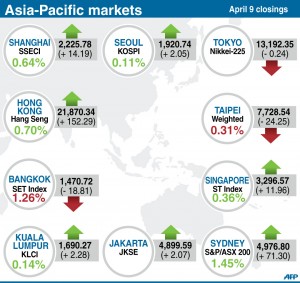

Tokyo ended flat, edging down 0.24 points to 13,192.35 following an almost 10 percent rally since Wednesday fueled by the Bank of Japan’s (BoJ) stimulus measures.

But Sydney added 1.45 percent, or 71.3 points, to 4,976.8, while Seoul was 0.11 percent higher, adding 2.05 points to 1,920.74.

Shanghai was 0.64 percent higher, adding 14.19 points to 2,225.78, while Hong Kong added 0.70 percent, or 152.29 points, to 21,870.34.

Beijing unveiled data on Tuesday showing inflation at 2.1 percent in March, well down from the 10-month-high 3.2 percent seen the month before and below forecasts for 2.4 percent.

Article continues after this advertisementThe news eased investor concerns that another high figure would prompt authorities to tighten monetary policy further.

Article continues after this advertisement“Markets were overly worried when headline CPI inflation jumped to 3.2 percent in February, so today’s reading will definitely help alleviate the inflation and monetary-tightening concerns,” Bank of America Merrill Lynch economist Lu Ting said in a note, according to Dow Jones Newswires.

Chinese shares have suffered in recent months on concerns about the world’s No. 2 economy, while the recent spike in inflation fueled expectations the government would tighten monetary policy.

Inflation is a key issue for the ruling Communist Party as it brings with it the risk of popular discontent and the threat of social unrest.

Japanese shares dipped after a four-day run that saw the Nikkei put on almost 1,200 points thanks to the tumbling yen which helps exporters. However, the Nikkei is still sitting at highs not seen since August 2008.

Tokyo investors have gone on a buying spree since the BoJ last week unveiled a huge stimulus package aimed at reversing decades of deflation.

The yen has lost almost eight percent since the bank announced its shift in monetary policy that will see a flood of cash hit financial markets.

In early European trade the dollar bought 99.00 yen from 99.36 yen in New York late on Monday—around levels not seen since May 2009.

The euro was around more than three-year highs of 129.01 yen, from 129.23 yen in US trade.

The European unit was at $1.3033 compared with $1.3005.

New York trading ended on a positive note, providing more lift to Asia in anticipation of positive earnings reports.

The Dow rose 0.33 percent and the S&P 500 put on 0.63 percent, while the Nasdaq added 0.57 percent.

Oil prices rose, with New York’s main contract, light sweet crude for delivery in May, adding 24 cents to $93.60 a barrel and Brent North Sea crude for May up 43 cents to $105.09.

Gold was at $1,571.97 an ounce at 1045 GMT compared with $1,577.10 late on Monday.

In other markets:

— Singapore climbed 0.36 percent, or 11.96 points, to 3,296.57.

DBS Bank added 0.06 percent to Sg$15.66 and Singapore Telecom gained 1.39 percent to Sg$3.66.

— Taipei ended 0.31 percent lower, shedding 24.25 points to 7,728.54.

Taiwan Semiconductor Manufacturing Co. fell 1.02 percent to Tw$97.5 while Hon Hai was 0.37 percent lower at Tw$80.5.

— Wellington was flat, edging down 2.00 points to 4,395.21.

Fletcher Building ended off 1.73 percent at NZ$8.50, Chorus was flat on NZ$2.69 and Telecom Corp closed up 1.67 percent at NZ$2.44.

— Jakarta closed flat, edging up 0.04 percent, or 2.07 points, to 4,899.59.

Food manufacturer Indofood Sukses Makmur rose 3.45 percent to 7,500 rupiah, while retailer Hero Supermarket fell 2.54 percent to 4,800 rupiah.

— Kuala Lumpur added 0.14 percent, or 2.28 points, to 1,690.27.

British American Tobacco rose 2.3 percent to 63.48 ringgit and UEM Land Holdings shed 1.4 percent to 2.86 ringgit.

— Bangkok lost 1.26 percent, or 18.81 points, to 1,470.72.

Coal producer Banpu fell 3.26 percent to 356 baht, while Airports of Thailand dropped 3.02 percent to 112.50 baht.

— Mumbai’s Sensex index fell 1.15 percent, or 211.30 points, to 18,226.48.

IT outsourcer Wipro fell 12.19 percent to 393.8 rupees while Infosys fell 2.36 percent to 2,766.35 rupees.

— Manila was closed for a public holiday.—Danny McCord