Gov’t set to raise FDI inflow projection for ’13

MANILA, Philippines—The government is set to raise its 2013 projections for foreign direct investments (FDIs), portfolio inflows, and the country’s merchandise imports due to the recent upgrade of the country’s credit rating.

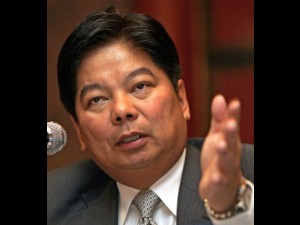

“We expect more … portfolio and FDI flows to … the country,” Governor Amando Tetangco Jr. of the Bangko Sentral ng Pilipinas told the Inquirer.

Last month, the Philippines received its first investment grade from a major international credit rating agency.

Fitch Ratings raised the country’s rating by a notch, from BB+ to BBB-, which is the minimum investment score.

The Philippines already enjoyed a favorable sentiment even before it received an investment grade, Tetangco said. The upgrade will only serve to further stoke business activities in the country.

In its original forecast for this year, the BSP said net inflow of FDIs to the Philippines could reach $2.2 billion, up from last year’s $2.03 billion.

Foreign portfolio investments were also expected to post a net inflow of $3 billion this year, lower than last year’s $3.88 billion.

BSP Assistant Governor Ma. Cyd Tuaño-Amador said the government’s projection on imports is also up for review because of the impact of the investment grade.

Originally, the government expected imports for the year to grow by 10 percent from last year’s $61.66 billion.

“We are also reviewing the imports figure because [an increase in FDIs will] lead to expanded business activities and greater demand for imports,” Amador told the Inquirer in a separate interview.

A change in the projections for FDIs, portfolio investments, and imports would thus affect the overall government forecasts on the country’s balance of payments (BOP) and gross international reserves (GIR).

The new projections on the BOP and GIR will be announced later this month, the central bank said.

BOP, which is a record of the country’s commercial transactions with the rest of the world, shows the inflow and outflow of dollars and other foreign currencies.

The original forecast was that the BOP would post a surplus of $3 billion this year.

GIR is the country’s total reserve of foreign currencies, resulting from a buildup in the BOP surplus.

In its original forecast, the BSP said the GIR would hit a new record high of $86 billion this year.

In adjusting the BOP and the GIR numbers, the central bank will take into account the potentially higher inflows of FDIs and portfolio investments, the higher outflows of foreign currencies due to higher imports, and the impact of the government’s recent decision to abandon its plans to borrow $1 billion from foreign commercial creditors this year.

The government decided to source its commercial financing requirements for 2013 entirely from the domestic market given the enormous dollar liquidity kept in the country’s banking sector.