Asia stocks fall on Fed doubts over bond buying

Transcripts from the Fed’s latest meeting, released Wednesday, showed some policymakers are worried that the bank’s $85 billion in bond purchases each month could eventually unsettle financial markets or cause the central bank to take losses.

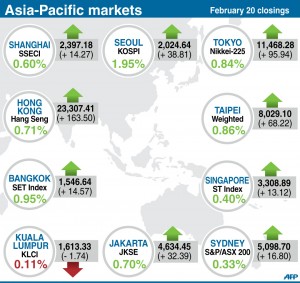

The Nikkei 225 in Tokyo fell 1.2 percent to 11,332.89. Hong Kong’s Hang Seng tumbled 1.8 percent to 22,897.63. Australia’s S&P/ASX 200 fell 2.1 percent to 4,991.30. South Korea’s Kospi dropped 0.5 percent to 2,014.74. Benchmarks in Singapore, Taiwan, mainland China and New Zealand also fell.

The signs of disagreement at the Fed turned investor sentiment negative, analysts said, throwing into question how long the U.S. central bank’s bond buying will last.

“The market is feeling pretty skittish, and anything like that is likely to cause some concerns,” said Andrew Sullivan, a trader at Kim Eng Securities in Hong Kong. “It’s one of the first signals that the Fed’s mood is changing from one of being very accommodative with easy money to start thinking about, ‘This isn’t going to go on forever.’ ”

By buying bonds, the Fed drives up their prices and lowers interest rates, which have stayed at record lows. That keeps costs low for mortgages and other types of loans. This approach to monetary policy is known as quantitative easing.

Article continues after this advertisementInvestors also turned cautious after being disappointed by a dip in U.S. housing starts. The Commerce Department said Wednesday that builders started work at a seasonally adjusted annual rate of 890,000 homes last month. That was down 8.5 percent from December.

Article continues after this advertisementDrops in commodities prices led resource stocks lower. Hong Kong-listed Zijin Mining Group, China’s largest gold miner, fell 3.3 percent. Jiangxi Copper Co. lost 3.5 percent. BHP Billiton, the Australian-based mining giant, fell 3.7 percent.

The news about the Fed contributed to the biggest loss this year for the Standard & Poor’s 500 index. The S&P 500 sank 1.2 percent to 1,511.95. The Dow Jones industrial average fell 108.13 to 13,927.54, a loss of 0.8 percent. The Nasdaq composite fell 1.5 percent to 3,164.41.

Benchmark oil for April delivery was down 87 cents to $94.35 per barrel in electronic trading on the New York Mercantile Exchange. The contract lost $1.88, or 2 percent, to finish at $95.22 on the Nymex on Tuesday.

In currencies, the euro fell to $1.3266 from $1.3281 late Wednesday in New York. The dollar fell to 93.46 yen from 93.81 yen.