MANILA, Philippines—The local stock market allied to a new record high on Tuesday, bucking the downtrend across the region, on good local macroeconomic outlook for 2013.

Overcoming rough trading early in the session, the main-share Philippine Stock Exchange index added 34.51 points or 0.54 percent to a new all-time high of 6,470.49. This marked the 15th record finish for this year and the 76th since President Aquino assumed office in mid-2010.

Dealers said the Philippine growth story amid a still cautious global outlook for 2013 was attracting new investors. A benign inflation rate of 3 percent in January also affirmed the soundness of the country’s macroeconomic fundamentals. At the same time, historically low interest rates have encouraged investors to seek better yields in equities.

John Sturmey, Religare global head of equity capital markets based in Singapore, said on Tuesday there was a good chance that the Philippine Stock Exchange index could rise by another 20-25 percent this year.

“Every single fund we talk to, they want to look at the Philippines,” he said.

The local stock market went up for the third consecutive day. The index is now nearing the 6,500-mark which President Aquino recently cited as wishful thinking for his birthday on Feb. 8.

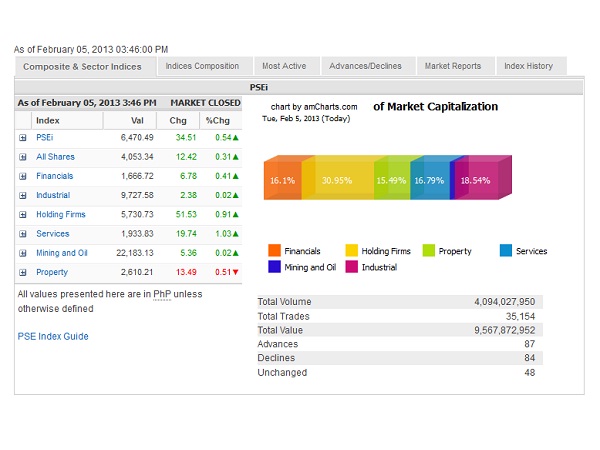

On Tuesday, all counters firmed up except for property (-0.51 percent). The biggest gainer was services (+1.03 percent).

Turnover for the day amounted to P9.57 billion. There were 87 advancers against 84 decliners.

The day’s biggest index gainers were AGI (+3.54 percent), SMDC (+2.99 percent) and ICTSI (+2.33 percent) while BPI, Petron, SMIC, BDO, Philex, PLDT and AEV also contributed large gains to the PSEi.

On the other hand, investors pocketed gains from Megaworld (-3.71 percent), Metrobank (-1.3 percent), ALI (-0.33 percent), SM Prime (-0.77 percent) and DMCI (-1.82 percent).

Outside of index stocks, Puregold and Bloomberry also fell on profit-taking.