International financial service firm Maybank has infused $100 million in fresh capital to its Philippine operations as it undertakes an aggressive expansion plan over the next five years.

Herminio Famatigan Jr., president and chief executive officer of Maybank Philippines Inc. (MPI), on Friday said in a press conference that the parent firm would want MPI to put up 25 additional branches each year, starting 2013, until its network in the country reaches at least 200 branches.

Currently, MPI has 54 branches nationwide.

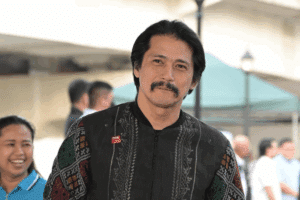

Dato Sri Abdul Wahid Omar, president and CEO of Maybank, said in the same press conference that the expansion plan was helped on by the bank’s encouraging outlook on the Philippine economy.

The bank expects demand for banking services to grow in various parts of the country, he said.

“The Philippines is another vibrant regional economy and has recorded strong GDP (gross domestic product) growth of 6.5 percent in the first nine months of 2012,” Omar said.

“As our regional operations become increasingly interwoven, we are confident that we can mine opportunities in numerous segments, such as electronic payments, cash management, remittances, investment banking, consumer banking, and wealth management, where we have the expertise and experience.”

Also, once the branching restrictions in key cities of Metro Manila is lifted in 2014 by the Bangko Sentral ng Pilipinas, MPI will begin to establish outlets there, Famatigan said. The restricted areas include the cities of Makati, Mandaluyong, Manila, Parañaque, Pasay and Pasig.

Maybank, which is based in Malaysia, also intends to publicly list MPI shares over the next three years to comply with a new BSP regulation, Omar said. The BSP regulation requires bank with foreign ownership to list shares in the Philippine Stock Exchange.

In 2012, MPI estimated its net income at P690.1 million—up by 90 percent from the P362.9 million recorded the previous year.