MANILA, Philippines—Local stocks ended modestly higher on Tuesday after a volatile session marked by increasing profit-taking temptation after a five-day run-up to new record highs.

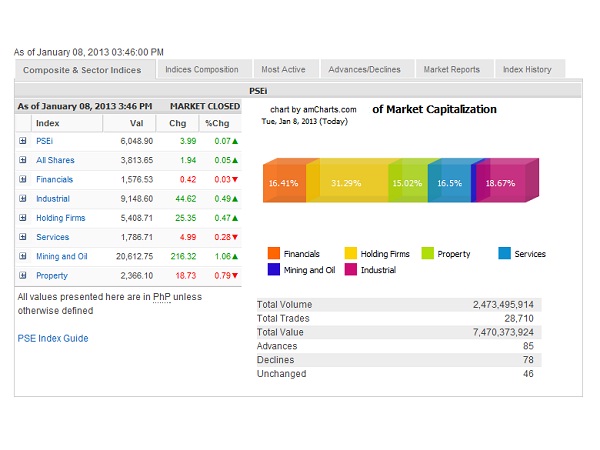

The main-share Philippine Stock Exchange index added 3.99 points, or 0.07 percent, to close at 6,048.90, a new record high finish. A new intraday peak of 6,055.42 was likewise hit for the day.

The index struggled through most of the session to stay in positive territory especially as most other markets in the region have succumbed to profit-taking.

The index gainers were FGEN, Belle, EDC, Philex, MWC, SMIC, AGI, ICTSI, DMCI and Jollibee.

On the other hand, there was profit-taking on Megaworld, MPI, URC, Meralco, JG Summit, ALI, Globe, PLDT, AP and SM Prime.

After conquering 6,000, the next key resistance for the index is seen at 6,100.

While investors are generally optimistic on good macroeconomic fundamentals behind stocks, one key concern is the proposed framework on foreign ownership to be issued by the Securities and Exchange Commission in the aftermath of a Supreme Court ruling on PLDT’s foreign equity case.

Lazard Asset Management Inc., which has nearly $1 billion invested in the local capital markets, said it might be forced to sell its holding if the regulations on foreign ownership in the Philippines would change.

“We believe that the limit on foreign ownership should continue to be calculated as a percentage of total shares outstanding as opposed to being segregated by share class. The new proposal, we believe, is unfairly grouping our passive interests with those of possible foreign strategic investors,” Lazard officials said in a letter to SEC chairperson Teresita Herbosa.