PH stock index slips after 3 days of ascent

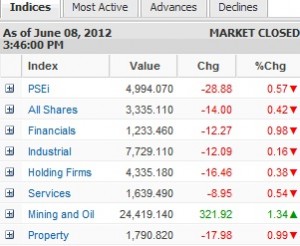

The main-share Philippine Stock Exchange index lost 28.88 points or 0.57 percent to close at 4,994.07.

For the week, the main index lost 68.37 points or 1.3 percent, reversing the 2.8 percent gain in the previous week when the Philippines benefited from a better-than-anticipated economic growth of 6.4 percent, a positive credit watch by Moody’s and President Benigno Aquino III’s political victory in the ouster of Supreme Court Justice Renato Corona.

In a research note, Metrobank said the local bourse was expected to trade flat with a downward bias due to the lack of positive near-term trading leads. It noted that Wall Street had closed overnight, losing much of Thursday’s gains.

“China’s interest rate cut boosted investor sentiment but early gains tapered off after Fed Chairman Ben Bernanke stopped short of signaling a commitment to a fresh policy action to support the US economy. Gold declined sharply after Bernanke’s comments. On the local front, macroeconomic fundamentals still post to be strong, but problems overseas will definitely weigh on investor sentiment,” Metrobank said.

At the local market, all counters ended in the red except for the mining/oil counter which was up by 1.34 percent.

Turnover was thin at P4.18 billion as external jitters continued to hound the market. There were only 53 advancers against 101 decliners while 41 stocks were unchanged.

The index was weighed down by PLDT, AGI, Metrobank, BDO, EDC, Megaworld, Philex, RLC and Aboitiz Power. Among non-PSEi stocks, PXP also fell in heavy volume.

The day’s index decline was tempered by the gains of Manila Water, DMCI, ALI, and Globe. Other stocks that bucked the downturn were Calata, PNB and Lepanto.

Shares of SMIC and Ayala Corp. were unchanged.

Meanwhile, China cut its benchmark lending rates by 25 basis points across all tenors while demand deposit rate was slashed by 10 basis points. As a result, one-year benchmark deposit and lending rates will be 3.25 percent and 6.31 percent, respectively.

This was China’s first interest rate cut since 2008.