Biggest ADB meet ends

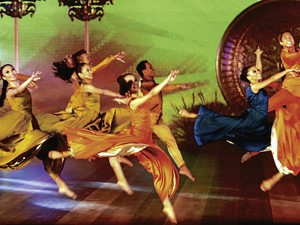

WELCOME AND GOODBYE. Filipino ballet dancers perform during the reception hosted by the Philippines for Asian Development Bank delegates at SMX convention center in Pasay City on Friday night. ARNOLD ALMACEN

The Asian Development Bank (ADB) ended the 45th meeting of its board of governors in Manila Saturday with key agreements among 13 Asian member-countries to boost their emergency protection against financial shocks as many of the economies in the region are threatened by a prolonged eurozone crisis.

The meeting, which was hosted this year by the Philippines, was attended by more than 5,000 delegates from 67 member countries—the highest number of participants so far in the history of ADB conventions.

“The annual meeting this year attracted the largest number of participants,” said ADB president Haruhiko Kuroda.

“We are happy to have had a successful annual meeting. The Philippines, Manila in particular, has showcased its hospitality to international participants,” Kuroda added.

Ann Quon, the head of ADB’s communications department, said the Philippines should be credited for its efforts to help make the meeting possible.

“We (the ADB) had a tremendous success in terms of number of participants, and so we credit the Philippine government for the great turnout,” Quon said.

The Asean+3 regional grouping agreed to double the size of their emergency liquidity program, the so-called Chiang Mai Initiative, to $240 billion and made it more readily available by reducing its compulsory link to the International Monetary Fund’s bailout conditions.

Asean+3 is a forum that functions as a coordinator of cooperation between the Association of Southeast Asian Nations (Asean) and the three East Asian nations of China, Japan and South Korea.

In a further move to protect their financial markets from shocks, the three East Asian economic powers in the Asean+3 agreed to boost cross-investment in government bond markets, worth nearly a combined $15 trillion.

The ADB conference from May 2 to 5 met under a cloud of uncertainty over the eurozone debt crisis and high oil prices cloud the region’s continued economic performance.

Policy discussions

Kuroda said the bank was very pleased with the important agreements made and policy discussions during the annual meeting.

The agreement to double the Asean+3 safety net fund comes as many export-oriented economies in Asia seek ways to avoid a repeat of the 1997/98 Asian financial meltdown after facing recent crises originating outside the region.

“We are fully aware of the potential downside risks to the region’s economic performance in 2012,” said the statement of the Asean+3 finance ministers and central bank chiefs who met on the sidelines of the ADB meetings.

“The prolonged sovereign debt crisis in the euro zone could continue to weigh on Asean+3 economies through the trade and financial channels. Inflationary pressures remain, driven, in particular, by rising oil prices,” it said.

From $120B to $240B

Under the Chiang Mai Initiative Multilateralization (CMIM) created in 2000 as a network of bilateral currency swaps, Asean+3 member-countries pool resources that can be tapped by any member suffering from insufficient dollar liquidity.

The agreement drawn up this week calls for boosting the size of the CMIM from $120 billion to $240 billion, while cutting the amount tied to an IMF program to 70 percent from 80 percent and extending the maturity of currency swaps.

Japan, China and South Korea will continue putting up 80 percent of the fund with Asean countries providing the remainder.

Asean+3 includes the Philippines, Indonesia, Malaysia, Thailand, Singapore, Hong Kong, Cambodia, Burma (Myanmar), Brunei, Laos (the 10 members of Asean), and China, Japan and South Korea (the +3 economies).

+3 mutually hold bonds

The region’s three economic powers struck a formal agreement on their mutual bond holdings, a rare one on securities investment, to safeguard their capital markets against possibly massive cross-border fund flows.

“We agreed to promote the investment by the foreign reserve authorities in (each other’s) government bonds, further strengthen our cooperation, including information sharing, and thereby enhance the regional economic relationship among the three countries,” China, Japan and South Korea said in a joint statement.

Local currency-denominated government bonds in the three countries amounted to $14.61 trillion at the end of 2011, with Chinese and Japanese bonds accounting for 97 percent of the total, ADB data showed.

A key theme of the conference was the pressing need to make economic growth “inclusive,” meaning growth that actually results in poverty reduction and does not only benefit the rich and the middle class, and the need to develop economies without damaging the environment.

Kuroda said Asia, despite the significant progress achieved by some countries in the region in the past decade, is still faced with a serious problem of poverty. In some Asian countries, economic growth is not translating into poverty reduction, he said.

“There are still hundreds of millions of Asians living on less than $1 a day,” Kuroda said.

Cash transfer programs

Some of the recommendations made to achieve inclusive economic growth is to increase investments in education and other social services, such as cash transfer programs.

ADB said it is supporting programs like the Philippines’ conditional cash transfer, believing this to be efficient in achieving inclusive economic growth.

Policy discussions at the meetings also focused on the need for countries to invest, or to seek financing, for projects that will help achieve environmental sustainability.

Kuroda said that growth must also be “green,” that is, economic development must not come at the expense of the environment. He said progress in the economic front would be meaningless if countries would eventually succumb to natural disasters resulting from degradation of the environment. He said pursuing “green growth” is important for Asia since many countries in the region are prone to natural calamities.

Middle-income trap

The need to develop Asian countries, like the Philippines, to finally graduate into becoming industrialized economies was also highlighted during the meeting.

Officials of various governments agreed that measures should be implemented for developing Asian countries to escape the “middle-income trap,” a phenomenon where a country, after transitioning from low- to middle-income, stagnates and fails to further develop into an advanced economy.

One of the proposals advanced is for governments and the private sector to invest more heavily in science and technology, and research and development to better compete with advanced economies. Innovation is needed so that growth will accelerate, Kuroda said.

PH gov’t cited for reforms

Another proposal was to institute reforms in government that would help make the delivery of public services more efficient, and thus make more resources available for funding developmental projects.

“Corruption and bad governance are a major obstacle to eradication of poverty in a much faster pace. [During the meeting] many developing member-governments recognized that corruption must be avoided and that governance must be substantially improved,” Kuroda said.

The ADB president cited the Philippines for the Aquino administration’s reform agenda.

“The current [Philippine] government has put anticorruption and governance improvement at the forefront of its poverty-reduction efforts,” Kuroda said.

Worth the effort

Philippine government officials said the country’s hosting of the ADB meetings was worth the country’s time and effort.

BSP Governor Amando Tetangco Jr. said the event helped make the Philippines better known before the world as a country that supports initiatives for economic cooperation and development.

“We, at the BSP, are privileged to have been part of the hosting of this year’s ADB governors’ meeting,” Tetangco said. The BSP owns the Philippine International Convention Center (PICC) where most of the events and forums were held.

He said the ADB meetings had again “showcased the strength of cooperation among Asian economies, and how far we have come to understand the needs of the region.”

“The meetings also reflected how, as a regional grouping, we are working toward concrete measures to ensure that we remain a driver of global economic growth and financial stability,” Tetangco said.

Back on int’l radar

“Manila 2012 has put the Philippines back on the radar screen of the international community,” said Finance Secretary Cesar V. Purisima.

“The success of this event highlights the parallelism of goals of the country and of the ADB, which is to achieve inclusive growth in the region,” Purisima said.

The country’s finance chief sat as chair of the bank’s board of governors until Saturday when he was succeeded by Pranab Mukherjee, ADB governor for India, which will host next year’s meeting.

“We have shown that we were able to do things smoothly, efficiently and promptly. This may sound petty, but improvements in these small things are tipping points” that can help make a better impression of the country to foreigners, said Finance Undersecretary Rosalia de Leon, who headed the team that organized the meetings.

Kuroda, in his closing remarks, thanked President Aquino and Purisima for the “excellent arrangements” provided during the meeting.

“Above all, I thank the people of Manila, whose inherent warm hospitality and support have made this a most memorable and successful event,” Kuroda said.

Not working

“I believe we can conclude our meeting for this year with a sense of confidence and optimism in the future,” the ADB chief said.

“Asia has an unprecedented opportunity to chart a new course and provide a better life for its people—and also to contribute to global growth and well-being,” he said.

But the militant Bagong Alyansang Makabayan (Bayan), which held a protest outside the PICC on Friday, said that increased poverty incidence in the Philippines was the strongest argument that economic prescriptions from the ADB are not working.

“The chronic problem shows that the economic impositions of lending agencies like the ADB are not working for the people,” said Bayan secretary general Renato M. Reyes Jr.

“Even the debt-driven, ADB-funded conditional cash transfer is not making a dent on the poverty incidence,” Reyes said.

The ADB is a regional development bank established on Aug. 22, 1966, to facilitate economic development of countries in Asia. It is headquartered in Mandaluyong City, Metro Manila.

Modeled on WB

The ADB bank admits the members of the United Nations Economic and Social Commission for Asia and the Pacific (Unescap) and nonregional developed countries. From 31 members at its establishment, ADB now has 67 members, of which 48 are from within Asia and the Pacific and 19 outside. ADB was modeled closely on the World Bank, and has a similar weighted voting system where votes are distributed in proportion with member’s capital subscriptions.

The highest policy-making body of the bank is the board of governors composed of one representative from each member state. The board of governors elect among themselves the 12 members of the board of directors and their deputy. Eight of the 12 directors come from Asia-Pacific members while the others come from nonregional members.

The board of governors also elect the bank’s president who is the chair of the board of directors and manages the ADB. Traditionally, and because Japan is one of the largest shareholders of the bank, the president has always been Japanese. With reports from Ronnel W. Domingo, and wire reports