FINTQ: ‘Sachet Banking’ is key to reaching unbanked Filipinos

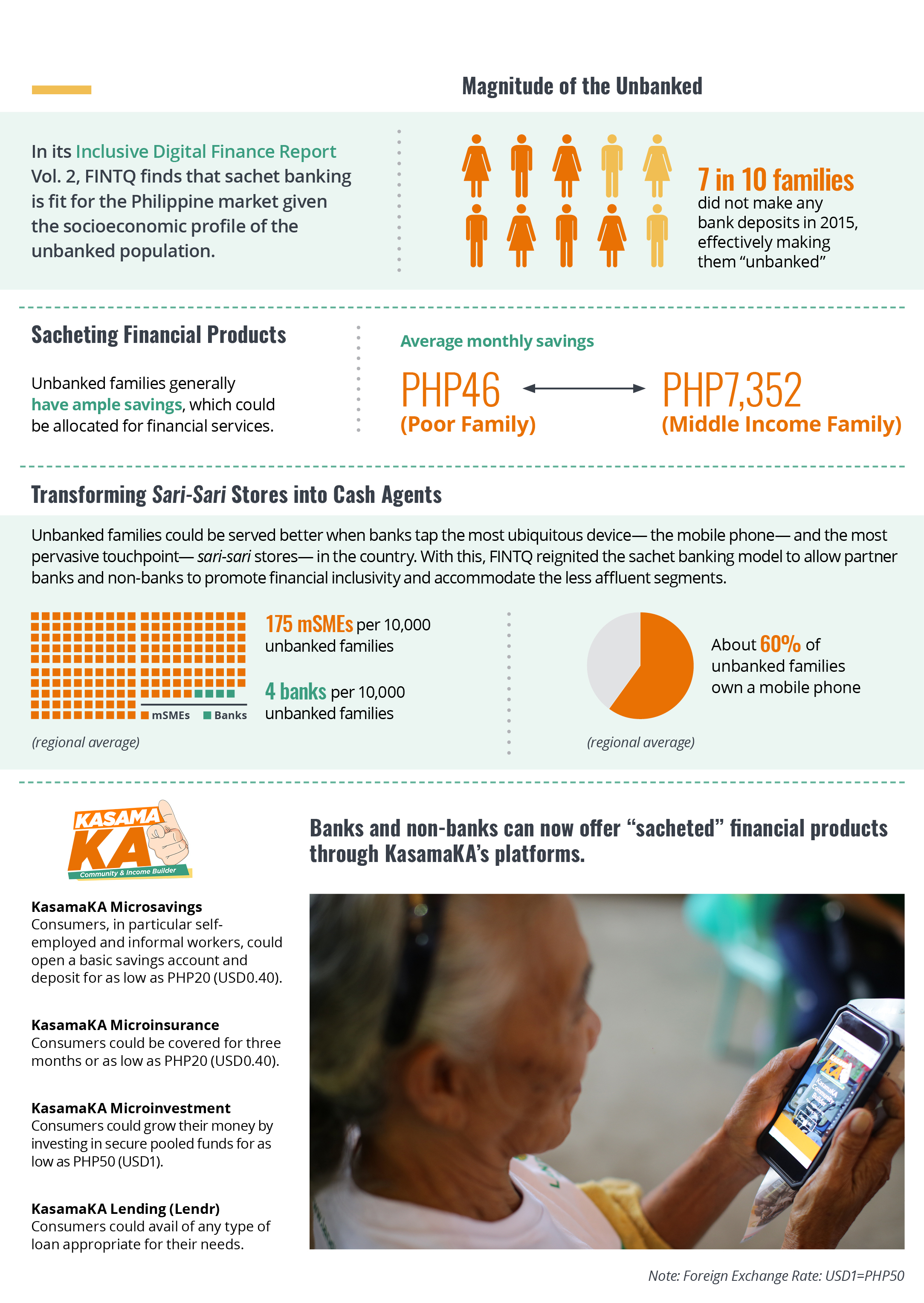

A radical innovation is set to accelerate the state of financial inclusion of the Philippines this year as FINTQ, the financial technology arm of Voyager Innovations, enables banks to introduce “sachet” banking products to communities. This agent banking model allows banks to tap micro, small, and medium enterprises such as sari-sari stores to act as cash agents to reach unbanked and underserved Filipinos through FINTQ’s platforms and network.

“Sachet banking is the last mile solution, and FINTQ is putting this innovation to scale. In the months to come, our products will allow consumers to deposit in their bank accounts small amounts, not directly at a bank branch, but through sari-sari stores and other mSMEs. We are doing this to enable our partners in the banking and finance industry so we can all accelerate the state of financial inclusion in the country,” said Lito Villanueva, managing director of FINTQ.

By transforming sari-sari stores into cash agents, banks could sustainably operate in low-density communities. By turning mobile phones into a “digital bank,” unbanked and underserved Filipinos could now open a savings account, apply for a loan, find affordable insurance, and make an investment without having to visit a bank branch.

The promise of sachet banking in the Philippine market is strengthened by the findings in FINTQ’s Inclusive Digital Finance Report Vol. 2, which was unveiled on January 18, 2018 at FINTQ’s Disruptors’ Ball, a gathering of the movers and shakers of the financial sector, luminaries from the government, non-government organizations and development partners of FINTQ.

Based on the 2015 Family Income Expenditure Survey conducted by the Philippine Statistics Authority, the report revealed that about 70% of Filipino families have no savings account, effectively tagging them “unbanked” under the survey’s definition. However, this segment earns ample income and owns assets that can help banks and non-banks to design financial products that are affordable for the majority of the unbanked segment.

“We aim to include 30 million Filipinos in the formal financial system by 2020. Our countdown has begun, and we count on our partners in bringing affordable and accessible products to the vast unbanked population,” Villanueva said.

ADVT