PSEi continues to weaken on profit taking

The local stock barometer slipped for the second trading session on Wednesday, defying the upswing in US and regional markets.

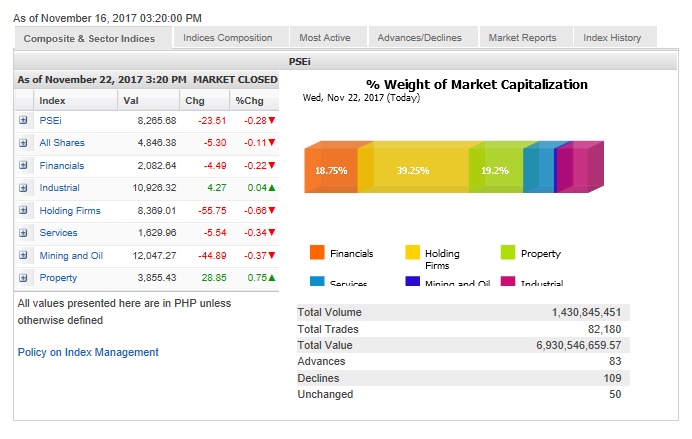

The main-share Philippine Stock Exchange index (PSEi) shed 23.51 points or 0.28 percent to close at 8,265.68 as investors pared down holdings in some large-cap stocks.

In particular, investors sold down telecom stocks to price in the potential entry of a third player in this sector, said veteran stockbroker Joseph Roxas, president of Eagle Equities Inc.

The decline was led by the financial, holding firms, services and mining/oil counters while the industrial and property counters edged higher.

Total value turnover for the day amounted to P6.9 billion. There were 109 decliners that edged out 83 advancers while 50 companies were unchanged.

The PSEi was weighed down most by retailer Puregold and banking giant BDO, which both slid by more than 3 percent.

SM Investments as well as telecom firms PLDT and Globe also slipped by more than 1 percent.

JG Summit, EDC and URC also declined.

One notable decliner outside the PSEi was Philex Petroleum, which lost 6.96 percent due to profit taking. It was the day’s most actively traded stock.

Roxas said the market’s attention was on Philex Petroleum on rumors that the Philippines and China have begun talks on joint oil drilling in disputed territory in offshore Palawan. As such, the company’s share price surged to as high as P12.34 a share—a 52-week high—before being hit by profit taking.

Even assuming that the talks have started, Roxas said the joint drilling “won’t necessarily happen tomorrow.”

On the other hand, Ayala Land, BPI and Semirara all gained more than 1 percent.

SM Prime, Meralco, Jollibee, Metro Pacific and Metrobank also slightly gained.

On the other hand, a number of non-PSEi stocks advanced in relatively heavy volume. One notable gainer was Macroasia, which surged by 5.41 percent.

Chemical and food input manufacturer D&L and MRC Allied respectively gained 1.93 percent and 1.27 percent.

Elsewhere in the region, stock markets were mostly higher, tracking the rebound in Wall Street after a two-day decline.