US debt deal powers PH, regional markets

The local stock barometer rose back to the 8,000 level on Thursday as a US debt ceiling deal perked up regional markets.

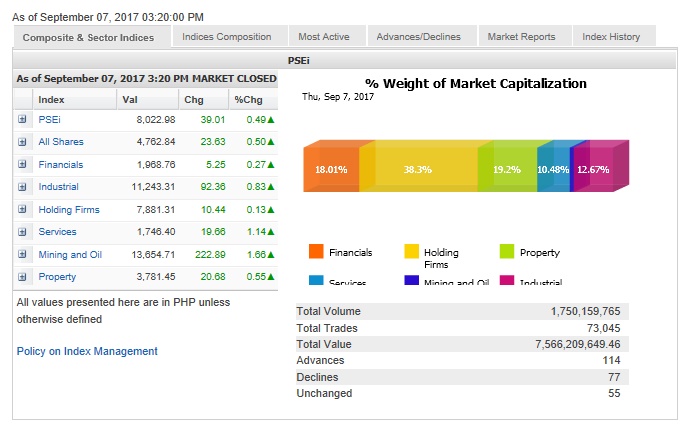

The main-share Philippine Stock Exchange index (PSEi) added 39.01 points or 0.49 percent to close at 8,002.98.

“Philippine stocks edged higher along with the US after congressional leaders and President Donald Trump agreed to extend the debt limit deadline and fund the government through mid-December,” said Luis Gerardo Limlingan, managing director at Regina Capital Development.

“The gains on Wall Street came as investors grappled with lingering concerns over North Korea, Hurricane Irma, and news that a key Federal Reserve official was resigning,” he added. US Fed vice chair Stanley Fischer said on Wednesday he would resign from his post in mid-October.

All counters ended higher, led by the services and mining/oil counters, both rising over 1 percent.

Value turnover for the day stood at P7.57 billion. There were 114 advancers that beat 77 decliners; while 55 stocks were unchanged.

Retailer Puregold led the PSEi higher with its 3.27-percent gain, while Megaworld rose by 2.32 percent.

Jollibee, ICTSI, Globe and Bloomberry all advanced by over 1 percent while SM Investments, Ayala Land, BDO, Metrobank, SM Prime, URC, Ayala Corp., Security Bank, GT Capital and MPIC also contributed gains.

Outside of PSEi stocks, one notable gainer was RCBC, which gained 2.24 percent and was the second most actively traded stock after SM Investments.