Financial inclusion, SE Asia style

The spotlight has been cast on micro, small and medium enterprises (MSMEs) as the Philippines chairs the Asean meetings this year.

The Association of Southeast Asian Nations is making great efforts to empower the region’s MSME segment, and reasonably so, as it makes up a large bulk of businesses in Southeast Asia.

MSMEs have served as the backbone of Asean economies, yet many small businesses never progress quickly enough to become large corporations with global or multinational expansion potential.

At the Prosperity for All Summit held in Manila recently, Asean leaders proposed reforms to ensure that small businesses and entrepreneurs have the means to compete in a global marketplace.

One of the approaches recommended is tapping digital technology to expand market access.

Digital technology

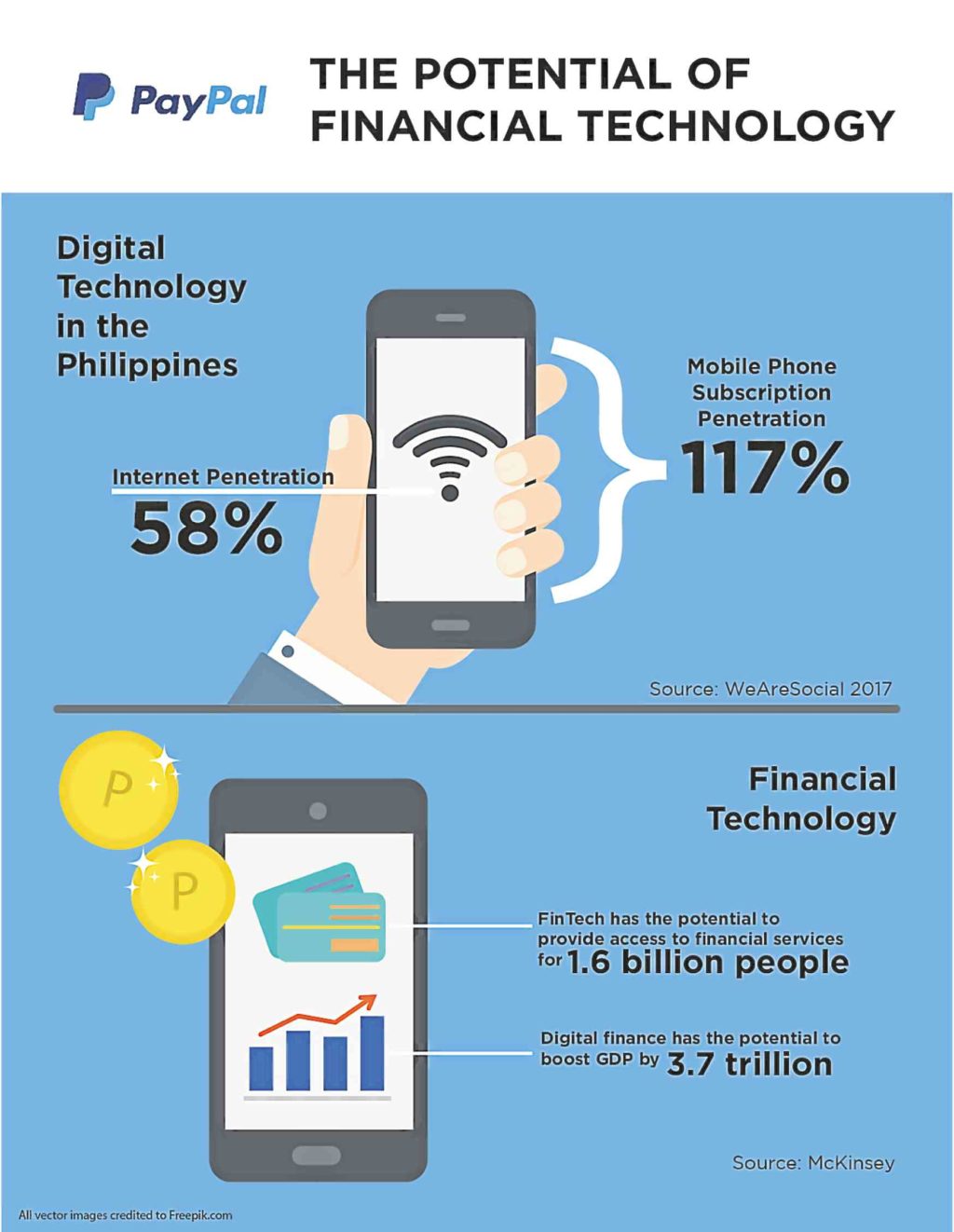

Internet penetration continues to rise in the Philippines, which now stands at 58 percent.

Coupled with the usage of social media at 58 percent penetration and mobile phone subscription penetration at 117 percent, the Philippines is in a “perfect digital storm” and is on the cusp of becoming a digital lifestyle capital, with unprecedented opportunities for startups and global brands alike.

More MSMEs need to be educated so they can understand the value of digital technology and e-commerce.

By utilizing the online platform and a myriad of technology tools at their disposal, such as websites, social media accounts, and social selling, MSMEs will be able to reach more clients and gain a wider access to the market, making them more competitive both locally and globally.

The Department of Trade and Industry (DTI) of the Philippines stresses the impact that digital technology and e-commerce can bring to MSMEs.

This recognition paved the way for the creation and implementation of the Philippine E-Commerce Roadmap 2016-2020, with an action plan based on key areas highlighted in the APEC Digital Prosperity Checklist.

Through its programs, the DTI is steadfast in its commitment to foster national development, promote inclusive growth, and reduce poverty by encouraging the establishment of MSMEs that facilitate local job creation, production and trade in the country.

Included in its programs are nationwide seminars and conferences on e-commerce that inform MSME owners and teach them how to take advantage of financial technology for their businesses.

As the 2017 chair of the Asean Business Advisory Council (ASEAN-BAC), the DTI pushes for inclusive, innovation-led growth in Asean.

One of the main goals of the council is to open up innovative and inclusive financing options for MSMEs, which include e-commerce and FinTech services.

Financial inclusion

Recent McKinsey studies have shown that FinTech has the potential to provide access to financial services for 1.6 billion people in emerging economies, more than half of them women.

The same study also shows that digital finance has the potential to boost GDP by 3.7 trillion or a 6 percent increase in GDP by 2025.

Reaching out to the unbanked population in Southeast Asia could increase the economic contribution of the region from $17 billion to $52 billion by 2030.

FinTech can help reach out to the unbanked. It has unlimited potential to drive economic growth and increase the financial health of billions of people.

Today, financial services are primed for the same technological transformation that has revolutionized many other industries.

The digitization of money, the rapid proliferation of internet access and mobile phones have created the perfect conditions to make it easier and cheaper to save, spend, give and borrow.

It helps hard-to-reach populations and small businesses to gain access to financial services at low cost and risk. People can be connected to affordable financial services anywhere and at any time.

The true opportunity for FinTech is not to deliver a plethora of bespoke or standalone financial products, or to simply move some services online, or create basic mobile applications. It’s to fundamentally reimagine financial services and make them more affordable, convenient and secure for everyone—particularly the underserved—and to do so at scale.

MSME partnerships and mentorship

It will require deep collaboration from the ecosystem on several levels to drive real growth and enact real change. The model of a digitally driven economy is one of connectivity, collaboration and community, facilitated by the sharing of information, resources and ideas. Nothing can operate or succeed in silo in this new economy.

The flagship initiative of the Asean-BAC, the Asean Mentorship for Entrepreneurs (AMEN), aims to empower MSMEs through partnerships with big companies who can provide them with greater opportunities, access to technology and better business management methods.

The program also aims to help MSMEs achieve sustainable growth by linking them to regional and global supply chains.

This aligns with the developments in FinTech, which has been bringing together a collaborative partnership between government, financial institutions and technology start-ups.

Partnerships such as this will lead to innovations that benefit livelihoods, ensure the stability and resilience of our financial system and contribute to a more vibrant global economy.

In my years at PayPal, I have seen first-hand the multiplier effect of integrated partnerships, especially with our merchants. PayPal has always been a strong supporter of freelancers and SMEs, which make up a significant proportion of our merchant customers, for the very reason that we believe that such partnerships create a strong ecosystem for innovation and creativity to thrive.

The role of FinTech leaders

The convergence of technology with the everyday calls for greater social responsibility for the leaders, both in government and the industry.

For us, as leaders in the FinTech arena, we have the real ability to help increase the financial health of all people in Southeast Asia.

This means that we have to continually deliver agile and relevant solutions that businesses, consumers and partners need in a globalized region.

As global leaders, we have to get closer to each of our people to understand their unique needs, wants and desires, their challenges and aspirations, and the real pain points they have. Only with this deep customer empathy can we help, and serve those underserved by the global economic system.—CONTRIBUTED