PSEi returns to 8,000

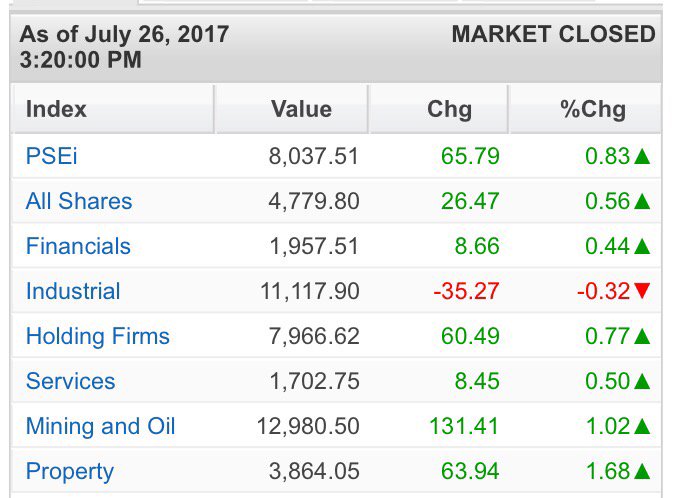

stock market performance July 26, 2017

The local stock barometer rallied to the 8,000 mark on Wednesday, hitting a new high for the year, on hopes for the passage of the Philippine tax reform law.

Climbing for the third straight session, the main-share Philippine Stock Exchange index gained 65.79 points or 0.83 percent to close at an 11-month high of 8,037.51. Across the region, stock markets were mostly higher as commodity prices surged ahead of the US Federal Reserve’s policy statement.

As the Philippine Congress has resumed its session, investors are now anticipating the passage of the tax reform law, said Eagle Equities president Joseph Roxas.

At the same time, he said the sell-off done by investors subscribing to the initial public offering of Chelsea Logistics may have abated, Roxas said.

The PSEi was led higher by the mining/oil and property counters, which both surged by over 1 percent.

Only the industrial counter ended in the red.

Value turnover for the day amounted to P8.17 billion. There were 98 advancers that edged out 94 decliners while 60 stocks were unchanged.

The market was also buoyed by net foreign buying worth P693.26 million.

Property developer Megaworld led the day’s upswing, rising by 5.51 percent, while conglomerate LTG also rose by 3.28 percent.

Ayala Land, SM Prime, Ayala Corp., GT Capital, JG Summit, ICTSI, DMCI and Semirara all firmed up by over 1 percent while Metrobank, PLDT, Metro Pacific and Meralco all firmed up.

Outside the PSEi, notable gainers included PXP which surged by 18.54 percent after Pres Duterte spoke about joint exploration with China at disputed territory off West Philippine Sea.

Petroenergy (+11.62 percent), Forum Pacific (+10.87 percent) and Philodrill (+8.33 percent) also gained.

In a commentary, Citi said an “unusually large price action ahead of the FOMC (Federal Open Market Committee statement) may signal a return of reflation trades. The litany of soft inflation outcomes is by now well-known and widely accepted, and a dovish Fed shift appears priced into markets.”

Reflation trade refers to a play on assets likely to benefit from rising growth and inflation, such as cyclical equities and emerging markets, while curbing exposure to long-term government bonds.

“Meanwhile, prices of industrial commodities are surging, with copper setting a new two–year high overnight, oil prices are finding further traction following Saudi assurances on output cuts, a seasonal improvement in US data surprises likely appears to be playing to script, and corporate earnings reports are reinforcing the message of a healthy business cycle,” Citi said.

At the same time, Citi noted that the US Senate Republicans were now pushing their healthcare bill a bit further while US President Donald Trump was preparing the ground for tax reform, despite mounting legal and political pressures.