Main stock price index rallies back to 7,800 on growth expectations

The local stock barometer climbed back to the 7,800 mark yesterday as investors anticipated a robust first-quarter domestic economic growth report.

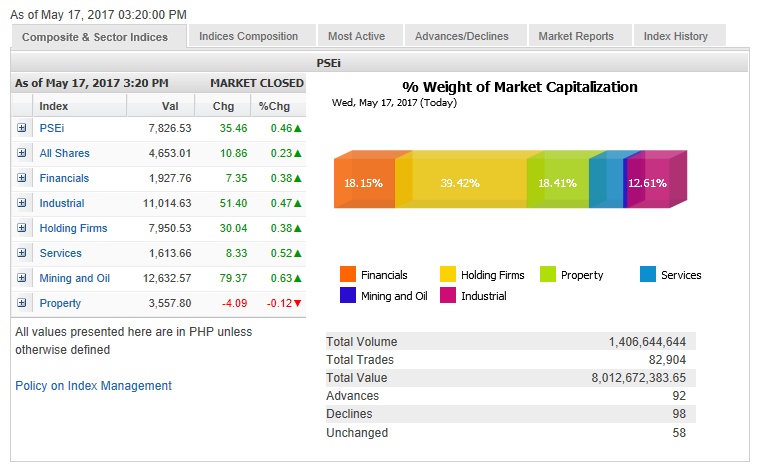

The main-share Philippine Stock Exchange index (PSEi) added 35.46 points or 0.46 percent to close at 7,826.53 on selective buying of large-cap stocks.

The market also priced in the latest adjustments in the MSCI index rebalancing and the final stream of first-quarter local corporate earnings.

Except for the property counter, all other sectors inched up.

“This is in anticipation of GDP (gross domestic product) growth,” said Joseph Roxas, president of local stockbrokerage Eagle Equities Inc.

Value turnover for the day amounted to P8.01 billion. Foreign investors were net buyers to the tune of P510.5 million.

Investment house First Metro Investment Corp. (FMIC) and University of Asia and the Pacific (UA&P), in their joint publication, said the domestic economy was estimated to have grown by 7 percent or higher in the first quarter. The joint research projected a solid recovery of agriculture (4-5 percent) and double-digit expansion of exports.

The government is set to announce the first-quarter GDP results today.

Despite the PSEi’s gain, there were more decliners (98) than advancers (92) in the market while 58 stocks were unchanged.

ICTSI rose by 2.16 percent while Petron gained 1.74 percent. Petron was added to the MSCI global small-cap index during the latest rebalancing, which will take effect at the close of trades on May 31.

Metrobank gained 1.14 percent while URC, Security Bank, SM Prime, SM Investments, JG Summit, BDO, Ayala Corp., PLDT, GT Capital, Megaworld and Metro Pacific also contributed gains.

On the other hand, there was profit-taking on AGI and Bloomberry, which respectively declined by 1.06 percent and 2.04 percent.

AGI rose sharply on Tuesday as it received higher weight on MSCI’s standard index.

Bloomberry had rallied in previous days after posting strong first-quarter results but yesterday, part of the decline was due to the reduction in its weight on the MSCI small-cap index.

ALI and BPI also slipped.

Moving forward, FMIC and UA&P expected the PSEi to pull back after recently testing the 8,000 level.

“With the slow progression of economic reforms in the US, investors (especially foreign) went on a buying spree to drive the PSEi to overbought levels. We expect a selling trend to take shape in May and flat out until August as the market undergoes healthy consolidation,” FMIC and UA&P said.