Going bananas and more

Banana is the only crop in many decades that reached $1.14 billion in exports in 2014 and $963 million in 2013. In 2015, it dipped to about $900 million, contrary to the government statistics of $440 million. More of this faulty export statistics later.

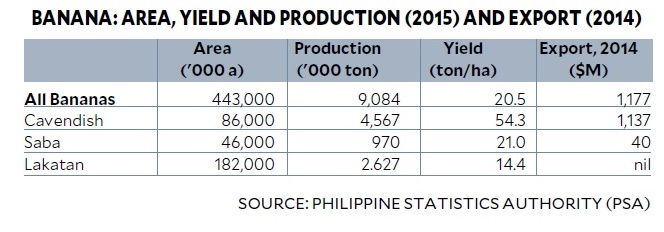

Banana comprises 8.2 percent of gross agriculture product in 2015, ranking 5th after rice, fishery, livestock and poultry. Among crops, it ranks second to rice and ahead of coconut, corn and sugarcane, despite its smaller area (443,000 ha) compared to palay 4.6 million ha, coconut 3.5 million ha, corn 2.6 million ha, and slightly ahead of sugarcane 421,000 hectares.

According to industry players, bananas (Cavendish, saba/cardava, lakatan, others) benefit directly and indirectly over 500,000 people, about half in Cavendish which stands on a solid value chain. Some P150 billion has been invested with annual wages of P4.5 billion.

Two recent events highlight the media visibility and vitality of the industry. First is the lifting of the ban by China on Cavendish export. Second is the holding of the banana congress in Davao in early October.

The lifting of the banana ban by China as headlined by the media is highly inaccurate. China has been applying non-tariff barriers on Philippine banana since the Scarborough affair. China had selected applications, be it violation of phyto-sanitary measures, or just plain harassment. But imports continue to grow.

President Duterte proposed that a Banana Industry Development Act be passed, instead of an Executive Order, to give strong impetus in the budget.

This future act is not new. The Sugar Alliance pushed for the passage of the Sugar Industry Development Act (2015), which is a model.

Faulty statistics

Philippine banana trade statistics lack reliability, especially in 2015. A look at the volume of exports of three major markets for 2013, 2014 and 2015 showed major discrepancies. The Philippines’ official data for 2015 appear to reflect only one semester data. Understandably, there is bound to be some differences (say, 10 percent) due to time period reckoning, but the actual differences appear excessive.

Some government officials attribute the massive drop in exports to El Niño: China—34 percent, Japan—62 percent, and Korea—70 percent! It was a horrendous fall compared to the imports of partner countries: China—11 percent, Japan—6 percent, and Korea—4 percent.

The future

The Banana Industry Council can look to the Sugar Industry Development Act (RA 10659 of 2015) as a model for the Banana Industry Act. Of the P2 billion annual appropriations under the Sugar Act, the components are: (a) block farming—15 percent, (b) farm mechanization —15 percent, (c) research and development (R&D), extension service and capacity building—15 percent, (d) scholarship grants—five percent, and (e) infrastructure (farm-to-mill roads, irrigation, others)—50 percent.

The mill district development councils will play a key role in extension services.

The proposed banana law should include the following key elements:

1. Establishment of a private-sector driven Banana Industry Development Council

2. Creation of a banana research center

3. Development of roadmaps by variety: Cavendish, lakatan and saba

4. Development of niche markets for Señorita bananas. Push for other varieties, such as lakatan, latundan, and other plantains.

5. Address tariff and non-tariff issues with Japan, China and Asean

6. Certification of legitimate exporters

7. Improved banana trade export statistics.

Given the global threat of Panama disease, a sustained focus on R&D to develop disease-resistant varieties is “mission-critical.” Other significant diseases which are causing economic losses for the growers include sigatoka, bunchy top, and moko (bacterial wilt).

Continuous benchmarking is vital as more countries are planting bananas, e.g., Cambodia, Myanmar, Laos, and Vietnam. These countries have lower cost of land and labor.

Ecuador, Guatemala and other Latin American countries have now firmly established their presence in Asia. Whenever they have excess which the US and Europe markets cannot take, they would ship these to Asia. Markets are China, Japan, South Korea, and Hong Kong.

With intensifying competition, the Philippines must not be complacent. Rather, it should strive to be more productive, quality-compliant and cost-competitive.