World nickel prices jumped in Q3

Global prices of nickel jumped 16 percent amid strong demand for stainless steel as well as the anticipated tightening of output from the Philippines following an audit of mine operations, according to the World Bank.

In its latest quarterly report on the commodity markets outlook, the World bank said the nickel market had already moved into deficit with falling production in the Philippines.

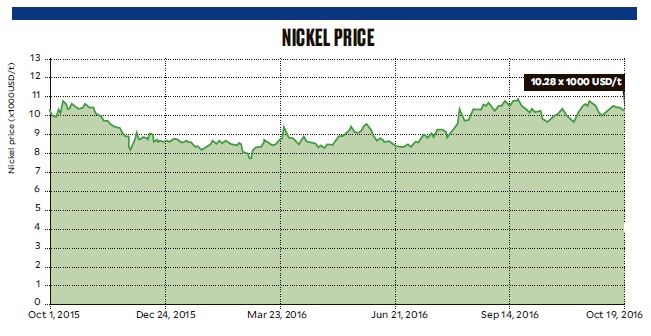

In the third quarter, nickel prices rose to an average of $10,258 per metric ton from $8,823 in the second quarter.

Third-quarter prices were the highest so far in 2016, which started at $8,508 in the first quarter.

Further, prices in the quarter ending September was just 3 percent shy of the $10,579 per ton recorded in the same period of 2015.

Citing data from the World Bureau of Metal Statistics, the report shows that the Philippines produced 317,000 metric tons of unrefined nickel in 2015, accounting for 17 percent of global supply.

Last year’s mine output from the Philippines meant a drop of 23 percent from 411,000 tons in 2014.

Also, the 2015 output was just about the same as that in 2013 (316,000 tons) and 2012 (318,000 tons).

In 2015, the Philippines was the top producer of unrefined nickel, with the Russian Federation at far second with 264,000 tons.

The Philippines was also top producer in 2014, accounting for 20 percent of worldwide supply.

The country gained the lead after Indonesia restricted the export of partially processed minerals including nickel.

The World Bank noted that last September, the Department of Environment and Natural Resources recommended the suspension of nickel mine operations that, together, represented 55 percent of domestic output or more than 10 percent of global supply.

“Nearly all of Philippine exports are shipped to China to feed its nickel pig iron (NPI) production,” the multilateral lender said.

The World Bank added that the nickel market had already moved into deficit with falling production output in the Philippines due to depletion and the declining NPI production in China.

“Meanwhile, Indonesia intends to revisit its January 2014 ore export ban, (which was) designed to encourage value-added domestic processing capacity, and may allow companies to export ore that are in the process of constructing smelter/refining operations,” the bank said.

“Inventories remain high, but key drivers will be policy developments in the Philippines and Indonesia,” it added.

Philippine Environment Secretary Regina Lopez earlier said the audit of mines would go on “unabated.” She has also ordered the review of about 800 environmental compliance certificates that the DENR has issued, including those for mining ventures.