Euro gains, Asia stocks advance on Greece deal hopes

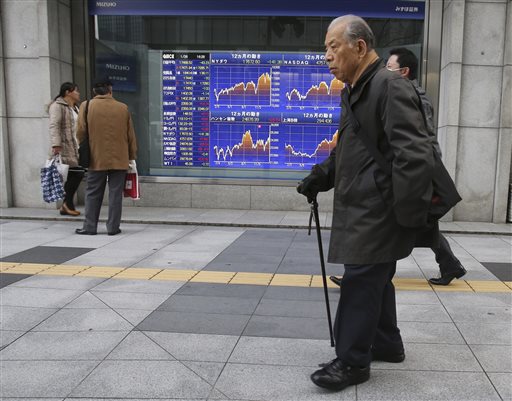

People walk by an electronic stock board of a securities firm in Tokyo on Monday, Jan. 26, 2015. Most Asian equities climbed on hopes Greece’s new government will be able to negotiate a bailout deal that will stop it leaving the eurozone. AP PHOTO/KOJI SASAHARA

HONG KONG–The euro extended its gains against the dollar Tuesday while most Asian equities climbed on hopes Greece’s new government will be able to negotiate a bailout deal that will stop it leaving the eurozone.

Regional dealers were given a lift from advances in Europe and New York, where news of Sunday’s Greek election win for anti-austerity party Syriza had been largely factored in, analysts said.

However, Hong Kong and Shanghai suffered heavy losses as traders booked profits after a rally over the past week.

Tokyo rallied 1.72 percent, or 299.78 points, to 17,768.30, Sydney added 0.82 percent, or 45.38 points, to close at 5,547.2 and Seoul rose 0.86 percent, or 16.72 points, to close at 1,952.40.

But Shanghai fell 0.89 percent, or 30.22 points, to 3,352.96 and Hong Kong eased 0.41 percent, or 102.62 points, to 24,807.28.

Shanghai had rallied more than eight percent since last Monday, when it posted its biggest loss since mid-2008 in response to a government crackdown on margin-trading.

Markets have been buoyed by rhetoric coming out of Athens and from Greece’s EU and IMF creditors that raised hopes the two sides can reach an agreement over repaying its 240 billion euro ($270 billion) bailout.

Syriza had campaigned on renegotiating terms of the lifeline–which included swingeing spending cuts and painful tax hikes–and there are concerns it will default on its repayments, potentially forcing it to exit the eurozone.

But International Monetary Fund head Christine Lagarde said she was prepared to continue financial support to the country, while some European finance ministers suggested they were willing to talk–as long as Syriza did not demand its debt be wiped out.

‘Risk-on mode’

The noises coming out of Europe helped drive shares higher. Equities in London, Paris and Germany all closed with healthy gains, although Athens lost more than 3 percent.

On Wall Street, the Dow edged 0.03 percent higher, the S&P 500 added 0.26 percent and the Nasdaq put on 0.29 percent.

“The Greek elections had the potential to unnerve the market,” Nader Naeimi, at AMP Capital Investors in Sydney, told Bloomberg News.

“It’s quite encouraging that the new government and the EU are willing to negotiate. The market is in a risk-on mode.”

Gavin Parry, managing director of Parry International Trading, added: “Concerns have eased that the anti-austerity policies of the new government will force Greece to exit the eurozone.”

The euro plunged to $1.1098 at one point in Asia Monday, the lowest level since September 2003, before recovering later in the day to close out in New York at $1.1234.

On Tuesday in Asia it bought $1.1250.

It also sank to 131.55 yen Monday in Asia before bouncing to end the day at 133.12 yen. It bought 132.90 yen in Tokyo Tuesday.

The dollar edged down to 118.11 yen from 118.49 yen in US trade.

Oil prices slipped despite a warning from the OPEC cartel that prices could punch $200 owing to shrinking investment in exploration.

US benchmark West Texas Intermediate for March delivery fell 10 cents to $45.05, while Brent crude for March eased 12 cents to $48.04.

Gold fetched $1,280.38 an ounce, against $1,281.39 late Monday.

In other markets:

— Taipei added 0.46 percent, or 43.92 points, to 9,521.59.

Taiwan Semiconductor Manufacturing Co. added 1.38 percent to Tw$147.00, while Hon Hai Precision Industry was unchanged at Tw$88.80.

— Wellington was up 0.69 percent, or 39.08 points, at 5,737.74.

Spark added 1.35 percent to NZ$3.39 and Air New Zealand rose 0.78 percent to NZ$2.57.

— Manila closed 0.58 percent higher, adding 43.90 points to 7,630.57.

Security Bank gained 1.42 percent to 149.50 pesos, while Metropolitan Bank and Trust Co. rose 3.05 percent to 98 pesos.

— Bangkok closed flat, edging up 0.09 percent, or 1.50 points, to 1,589.81.

Bumrungrad Hospital lost 3.34 percent to 159 baht, while Bank of Ayudhya dropped 7.37 percent to 72.25 baht.

— Mumbai advanced 1 percent, or 292.20 points, to end at 29,571.04.

Axis Bank rose 4.83 percent to 592.30 rupees, while Dr. Reddy’s Laboratories fell 4.01 percent to 3,210.65 rupees.

— Jakarta ended up 0.33 percent, or 17.13 points, at 5,277.15.

Cigarette manufacturer Gudang Garam gained 2.45 percent to 58,500 rupiah, while mobile phone provider Indosat slipped 0.61 percent to 4,075 rupiah.

— Kuala Lumpur gained 6.73 points, or 0.37 percent, to close at 1,803.17.

Public Bank added 0.33 percent to 18.12 ringgit, RHB Capital rose 0.13 percent to 7.81 while Tenaga Nasional lost 0.53 percent to 15.00 ringgit.

— Singapore climbed 0.40 percent, or 13.68 points, to close at 3,412.20.

OCBC Bank fell 0.29 percent to Sg$10.44, while oil rig maker Keppel Corp. ended the day up 1.23 percent at Sg$8.26.