Why I am not in favor of the P70,000 tax-exempt benefit

Many of my friends will hate me for what I will say.

I am not in favor of this bill increasing the P30,000 tax-exempt bonus to P70,000.

This is not to say I am not in favor of giving more tax relief to taxpayers, especially to the lower-income group, because I am. Truly, I am.

But this proposed bill, which favors only the employed sector, may result in inequity among the lower income levels, and it lessens the progressivity of the tax structure.

Why do I say this?

First, the bill is biased against self-employed individuals as it works only to favor those who are employed.

Second, higher-salaried individuals get higher tax relief compared to the low-salaried workers.

This is where my objection lies. Let me explain.

Biased against self-employed

Since time immemorial, employment, as a means of livelihood, has always been favored in this country from the perspective of taxation.

This could be the reason why we are basically an “employment-minded” country and not business-oriented as compared to other neighboring countries.

The government, under past and present administrations, has been pushing for entrepreneurship to bring about the “big leap” in economic growth, more so, inclusive growth.

But efforts to encourage the growth of small businesses have not progressed, or I would say, not as much as the government wanted to. Why? Because our current tax structure does not support it.

A person employed enjoys the following tax benefits: (a) P10,000, as the tax exemption base for individuals; (b) P30,000 received as bonus, 13th month pay and other benefits (which is proposed to be increased to P70,000); and (c) the minimum wage exemption. A minimum wage earner (MWE) is given full tax exemption on salaries, overtime, hazard, and night differential.

A self-employed person, on the other hand, is given only a tax exemption of P10,000 which is the general tax exemption base. Nothing more.

Who are the self-employed? These are the owners of micro, small and medium enterprises (MSME) like carinderias, barbershops, dress shops, tricycle drivers, side-street vendors, home-based businesses and many other small businesses, who, like those under employment, are also struggling to earn a living.

They also include the professionals, the independent consultants, the talents, the artists, the singers and all those trying to make a living in the exercise of their profession and talent.

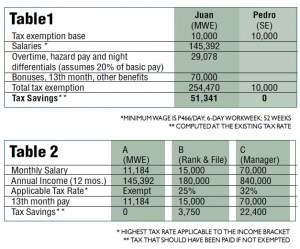

For clarity, let me use the case of Juan and Pedro as examples (Table 1). On the assumption that the P30,000 tax-exempt bonus is increased to P70,000, the table below shows the tax benefit of Juan, a minimum wage earner (MWE), compared to Pedro, an owner of a small home-business (SE).

At the current minimum wage levels, an MWE saves P51,341 from taxes yearly and this amount will correspondingly increase as there are adjustments to minimum wages. The MWE exemption is adjusted to inflation through adjustments in minimum wage pays. This amount may increase further if there are de minimis benefits received by the MWE.

But Pedro, the poor self-employed businessman, does not enjoy any tax savings at all.

Indeed, this current tax structure is biased against small businesses, the SMSEs.

The big question is WHY?

Is it because they are pictured as not declaring their true income anyway and they have more leeway to minimize their taxes compared to employees whose earnings are taxed even before they receive it?

But if the tax system is designed with this in mind, isn’t it giving a wrong signal that tax evasion is an accepted practice from this sector and that the government cannot do anything to curb it?

Or, is it because the tax on salaries is based on gross amount without deduction while small businesses are entitled to deduction?

But deductions are just a way to recover capital infused in the business, something which an employee does not need to do.

Or, is it because they are a neglected sector? Or, they are not organized strong enough to lobby for their interest?

Whatever it is, it is time to change our mindset and give MSMEs the much needed tax relief which, for a long time, have been enjoyed by the employed sector.

It is time we give the necessary incentives, taxwise or otherwise, to encourage Filipinos to become entrepreneurs.

Bigger relief

The increase in tax-exempt benefits to P70,000 is meant to adjust the existing exemption of P30,000 to its current value. The benefits covered under this exemption are the 13th month pay, bonuses, and any other benefits given by an employer to an employee.

Of these benefits, only the 13th month pay is mandated by law while the rest are based on the generosity of the employer.

Thus, in many situations, the tax exemption is applied only to the 13th month pay which could mean that for an employee to enjoy the full benefit of the P70,000, his salary must be at least P70,000 monthly.

On this premise, let me show you Table 2 to prove my point.

Let us take the example of three employees in different levels and pays.

Employee A is an MWE, Employee B receives a little over the minimum wage pay, say a monthly salary of P15,000, and Employee C, a managerial employee receiving P70,000 a month.

Of the three employees, the MWE does not benefit from this P70,000 exemption because it is already exempt under the law.

A rank and file employee enjoys a tax savings of only P3,750 which is much lower than the P22,400 savings of an employee receiving a monthly salary of at least P70,000.

The reasons for having lower tax benefit for B, the rank and file, compared to C, the managerial employee are: first, the benefit of P70,000 could not be fully utilized by B because benefits received (i.e. 13th month pay) could be lower than the ceiling of P70,000, and second, his annual income may fall on a lower tax bracket, hence, lower tax rate applies.

Our tax system has seven income brackets—as the income increases, the tax rate increases.

At the level of P70,000 monthly salary, the income is already subject to the highest tax rate of 32 percent.

As you can see from the above table, the progressivity of the tax system is reduced. Those receiving higher income are given more tax benefits. This reminds me of the Fringe Benefits Tax (FBT) which, many claims, is anti-poor.

It is anti-poor because when the fringe benefit is received by a rank-and-file employee, the tax on the benefit is deducted from the pay of the employee. On the other hand, if received by a supervisorial or managerial employee, the employer (not the employee) pays the tax.

Our Constitution mandates a progressive system of taxation. Those who have less in life should pay less tax, while those who have more should pay more tax.

As much as possible, laws that lessen the progressivity in the tax system should be avoided.

The better alternative

Tables 1 and 2 show that the proposed P70,000 tax exempt benefit is defective.

It discriminates against self-employed in favor of those employed. And even among those employed, it discriminates lowly paid employees against those receiving higher salary.

The better alternative (which I strongly recommend) is to give an across-the-board tax exemption by increasing the tax exemption base which is currently at P10,000 only.

To what amount?

This amount should be increased to exempt the income of a person which he needs to meet his basic needs—food, shelter, clothing, health, not to mention, even education.

We can call this “subsistence income”—the level of income just enough for a person to spend for basic necessities.

It can also be called “survival income.”

This was the rationale for exempting the MWEs whose earnings are just enough for them to have a decent living.

Thus, from Table 2, the income of an MWE amounting to P254,270 is granted exemption from taxes. This could be a good amount to consider.

But to avoid “bracket creep,” this should be indexed to inflation and adjusted periodically, ideally, every three years.

In the 1990s, although not in the law, the BIR coined a similar word for this—the “marginal income earners (MIE).”

Those with gross sales of not exceeding P100,000 are considered MIEs. The MIEs were given certain tax concessions, such as exemption from maintaining books of accounts, and paying their taxes since they are not considered engaged in business but are only earning for a living.

Giving tax exemption by increasing the tax exemption base, rather than giving a selective sectoral exemption, will even the playing field for all taxpayers belonging to the same income-level group.

It will promote fairness and progressivity in taxation. It will have the effect of an across-the-board exemption to be enjoyed by all, whether employed or self-employed and of whatever class of income.

(The article reflects the personal opinion of the author and does not reflect the official stand of the Management Association of the Philippines. The author is board member and secretary of MAP, governor-in-charge of the MAP Tax Committee, and the managing partner and CEO of the Du-Baladad and Associates [BDB Law]. Feedback at <[email protected]> and <[email protected]>. For previous articles, visit www.map.org.ph.)