Investment advisor talks about drivers of PH growth

BALDIVIA holds office at the University of the Philippines (UP) Science and Technology Park-South. His company’s name was derived from the UP Carillion bell tower. He says, “We initially wanted something auditory—a call to invest in the Philippines.”

Gerald Baldivia is one of the founders and managing directors of Carillion Partners, a company established in 2012 to provide investment, strategic, and financial advisory services to investors and investees in the private equity and venture capital markets in the Philippines.

Formerly an executive director at ATR Kim Eng Asset Management and a former investment officer at the World Bank’s International Finance Corporation, Baldivia (together with his partners, Dan Pagulayan, Mari Gomez, S.P. Sumulong, Eric Jurado, and Kip Thompson) found the need to serve as an intermediary between small entrepreneurs and big corporations seeking potential investment opportunities.

“There’s a trust deficit in Philippine business culture,” Baldivia explains. “Many small and promising businesses are usually started by families or solo entrepreneurs. Many of them don’t seize the opportunity to grow by employing the equity capital of others. Our role is to serve as a professional intermediary.”

Baldivia says that the Philippine economy is run by a few large corporations. He believes that the legs of an economy come from the small and medium enterprises and that there is a missing development of mid-sized firms. The shortage of capital is also a concern that needs to be addressed.

“Bank loans are not enough. You need additional equity or else you’ll be over leveraged,” he notes.

Baldivia provided an example on a case they were working on: “This company was being wooed by a major newspaper and a listed conglomerate in the magazine business. This company was already serving markets in North America and Europe. The founders (Carillion Partners) knew that if they sold out to big suitors, the company will change beyond recognition and will become a small subsidiary serving a niche market. We got to know them. We told them if you have bigger ambitions than the Philippines and want to stick to the original business plan, we need to find you investors who will not bend you toward their existing businesses. As of this time, the company’s preference is to remain independent.”

The sourcing of funds is a challenge that Baldivia and his partners are faced with and one that depends on personal connections.

“Traditionally, the Philippines has not been an easy sell for its poor reputation as a destination for foreign direct investments (FDI).” This is due mainly to deficiencies in governance and infrastructure.

Notwithstanding the inefficiencies, Baldivia finds great promise in the Philippines. According to him, the drivers of economic growth lie in the country’s young working population and the overseas foreign workers (OFWs).

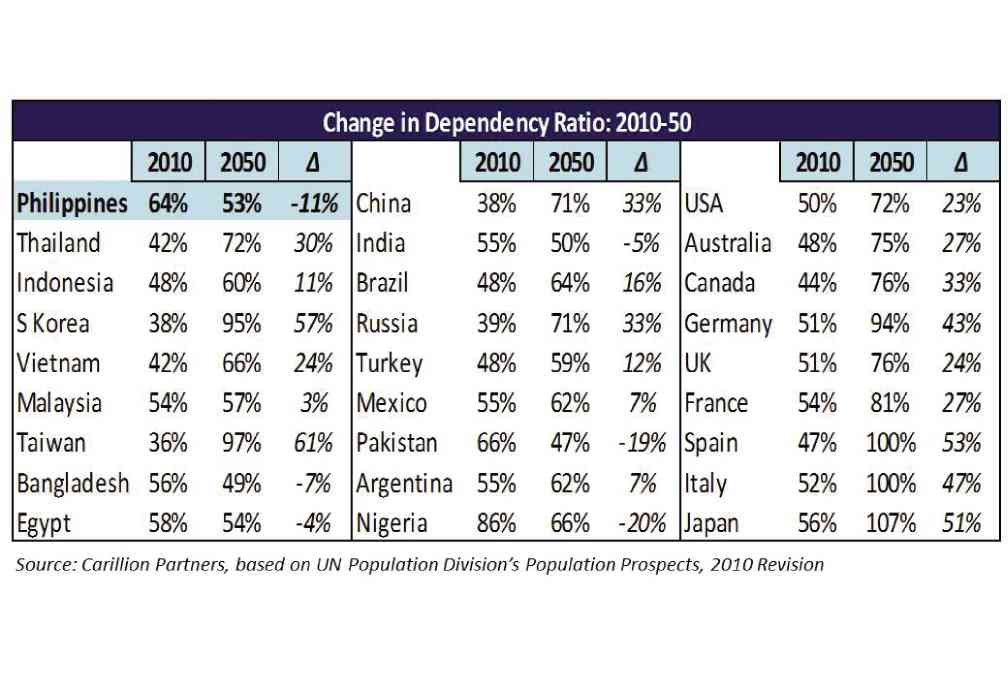

THESE statistics project that the Philippines will have a negative dependency rate by 2050 while other economies such as Japan and China will have a higher dependency ratio.

“The Philippines is getting stronger and stronger regardless of the governance situation,” he states.

According to Baldivia, three companies (HSBC, Citigroup, Goldman Sachs) conducted studies on the ten fastest growing countries in the world with a projected period starting 2010 to

2050.

He discovered that in the three lists, the Philippines was the only country that was common in all the studies and the three companies projected at least 7 percent per annum GDP (gross domestic product) growth for the Philippines.

He dug deeper trying to understand why the Philippines stood out. He looked at both population growth and per capita GDP.

“I found out that the Philippines has one of the fastest growing working age population in the world.” According to statistics provided by the United Nations Population Division, the projected working age population growth from 2010 to 2015 is 80 percent. Furthermore, he also checked the dependency ratio (working age population divided by total population) and found that it is projected to decline from 64 percent in 2010 to 53 percent in 2050. “More people will be working than will be dependents,” he explains.

Overall, his company’s medium to long term Philippine outlook remains positive. “What we expect to see would be the continuance of a reasonably benign economic environment for growth,” he says. What this means is the expectation of low inflation rates and that the Philippines will remain one of the fastest growing economies in Asia for at least the next decade.

With regard to his startup company Carillion Partners, he explains that it is a long gestation business and while they already have revenues, they are still building the business. But he doesn’t hesitate when asked if he plans to stay on with the company.

“I’m definitely sure to continue. This is my life’s work,” he assures.