Slow growth a wake-up call for gov’t to act on constraints

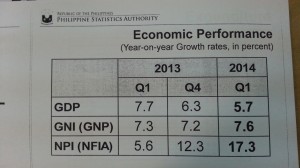

MANILA, Philippines–The weaker-than-expected Philippine gross domestic product (GDP) growth of 5.7 percent in the first quarter was not bad but nonetheless a wake-up call given growth constraints and other risks that loomed in the horizon, economists said.

“The slower growth, in our view, also helps inject a dose of realism into the overly bullish growth expectations that many fear will lead to asset bubbles and cloud prospects for sustained expansion over a longer horizon,” said Romeo Bernardo and Marie Christine Tang, economists at New York-based think tank Global Source.

In contrast to equity traders who had sold stocks on the news, Global Source said in its latest research that the first-quarter GDP report—albeit much lower than the market consensus of 6.4 percent—was “not bad at all” as the Philippines was still the third fastest-growing economy in the region even with the lingering destructive effects of last year’s natural disasters.

Global Source was keeping a GDP growth outlook of 6.1 percent for the Philippines this year but noted that downside risks could come from the severity of some new developments, including the Manila City truck ban, the El Niño dry spell and other infrastructure constraints, especially power.

“We are also on alert to any negative impact that the pork barrel scandal may have on public spending, especially after the budget secretary (Florencio Abad), who has been spearheading reforms to increase the transparency of budget processes and quicken disbursements, was included among the hundreds of former and present lawmakers implicated by the alleged mastermind of the scam (Janet Napoles), tagging him as being the real mastermind who mentored her,” Global Source said.

“While we find this simply bizarre, even by Philippine political tragicomedy standards, there is still the risk that a major misstep in handling the scandal will cost the administration invaluable political capital necessary to keep business confidence up in the short-term [and even beyond 2016],” the think-tank said.

Infra spending

While debt service in the public and private sectors had shrunk significantly over the years, Bank of the Philippine Islands economist Emilio Neri Jr. said very little of the funds spared for meaningful spending capital—such as airports, seaports, power plants, national highways, barangay roads, bridges, post-harvest facilities, irrigation, crop technology for agriculture and manufacturing productivity— had been mobilized.

“We hope these numbers will be a wake-up call for both government and the private sector about how little our economy has taken advantage of the scope to spend given the very affordable financing available in the local financial sector,” Neri said.

BPI is still expecting a full year 2014 growth of 6.2 percent for the Philippines, much faster than its peers.

Following the first-quarter GDP report, Citi pared down its 2014 GDP growth forecast on the Philippines to 6.7 percent from 6.9 percent but retained the 2015 growth outlook of 7.3 percent.

Jun Trinidad, Citi economist for the Philippines, said the first-quarter results were “disappointing” but noted that quality of growth remained superb. “Infra spending and fiscal crowding-in effects support second-half construction recovery and sustain strong business capital spending. Upbeat business confidence ushers restocking,” he said.

Domestic demand is still likely to resume growth of 7 percent year-on-year or more in the second half. From 21.3 percent in 2013, Trinidad said the share of real investments to GDP would rise to 21.9 percent.

“Optimism is riding high in the Philippines and the slower-than-expected growth rate in first quarter 2014 will not dampen the mood,” said Trinh Nguyen, economist at HSBC, adding that the slower first-quarter growth reflected the loss of agriculture output from Super Typhoon Yolanda.

Above trend rate

“This has been our view: Growth is expected to slow to 5.9 percent in 2014 from 7.2 percent in 2013 but is still above trend, thanks to sticky household consumption in the Philippines,” Nguyen said.

“With sluggish global demand, frequent natural disasters and limited spending on infrastructure, the pace, although slowing, is still rather impressive,” she said.

Barring another political crisis, Global Source said it was inclined to favor a curve that gently slopes up, keeping its 6.1-percent GDP forecast for the Philippines at this time.

“We do not expect growth to return to the 7-percent level mainly because of infrastructure constraints which, notwithstanding much publicized expressions of interest, will continue to deter actual private investments. However, we are slowly gaining confidence in the government’s drive to meet expenditure targets, especially with increasing media attention on the slow pace of reconstruction works, and thus, we expect GDP growth to improve by second half of 2014,” Global Source said.

BPI’s Neri said he was hopeful that the first-quarter GDP results would be the slowest for the year, noting that this disappointing headline number was eroding expectations of the Philippines economy’s ability to sustain its favorable debt-dynamics even just through 2016. “Until second-quarter 2014 data come out, there will be uncertainty among market participants [and rating agencies] on whether the Philippines has finally lost its growth momentum or if today’s weaker-than-expected GDP print was merely a soft patch,” he said.

RELATED STORIESNeda: PH economy grew 5.7% in 1Q of 2014

Economic growth still impressive, says HSBC