BSP seen keeping interest rates low

The Bangko Sentral ng Pilipinas (BSP) will likely keep interest rates at record lows until yearend, barring any surprises that may lead to instability in consumer prices or weaker economic growth.

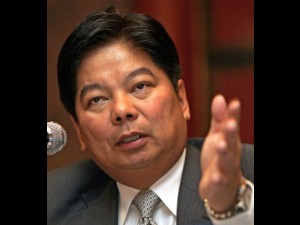

BSP Governor Amando M. Tetangco Jr., however, stressed that the policymaking Monetary Board has enough tools in its arsenal to counter any external forces that may threaten to knock the local economy off its stable footing.

“Barring any unforeseen threats, I think we have room to keep policy rates steady for the balance of the year,” Tetangco told financial market players this week. “Should market reaction/sentiment lead to a loss of overall business confidence or a dis-anchoring of inflation expectations, the BSP has the room to adjust policy interest rates or other monetary policy tools, as appropriate.”

Tetangco was speaking at a closed-door joint assembly of the Fund Managers Association of the Philippines (FMAP), the National Association of Securities Broker Salesmen Inc. (NASBI), Trust Officers Association of the Philippines (TOAP), the Investment House Association of the Philippines, the Money Market Association of the Philippines and the Association Cambiste Internationale (ACI)-Philippines.

The BSP’s benchmark overnight borrowing and lending rates stand at record lows of 3.5 and 5.5 percent, respectively.

In his speech, Tetangco noted three major risks to the BSP’s monetary policy settings, namely, the uncertainty of easy money policies in the United States, high liquidity growth locally and economic conditions overseas.

He said the schedule of the US Federal Reserve’s tapering of its bond-buying program could lead to one of two situations: Excessive exuberance that could inflate asset prices or disappointment that could bring prices crashing.

Tetangco said the BSP would respond by further tweaking existing macroprudential measures or release new ones, as appropriate to target problem asset areas.

Meanwhile, he said market players need not be concerned over what seems to be excess liquidity entering the system as funds from the central bank’s Special Deposit Accounts (SDA) are released following restrictions on individual investors parking their funds in facility.

Tetangco pointed out that investors who used to put their funds in SDAs usually have low-risk appetites. Hence, once these funds exit SDAs, these would likely be diverted to other low-risk asset classes—reducing the possibility of the formation of asset bubbles.

Tetangco said the most uncertain risk the country faced were economic conditions in major trading partners that might affect growth locally.

Apart from the country’s trade ties with Europe, China and Japan, the Philippines may also see a slowdown in growth in remittances from migrant workers based in those markets as well as fewer international tourists.

Tetangco said that at the moment, the consensus was that Europe could possibly keep its growth rate stable, Japan would calibrate its stimulus, learning from the experience of the Fed on the problems of exit from unconventional monetary policy, and China would continue to grow at a steadier pace.

“We are monitoring these economies, but we are also mindful that our own domestic demand conditions, particularly consumption and capital formation, remain quite strong,” Tetangco said.