Local stock prices, peso fall

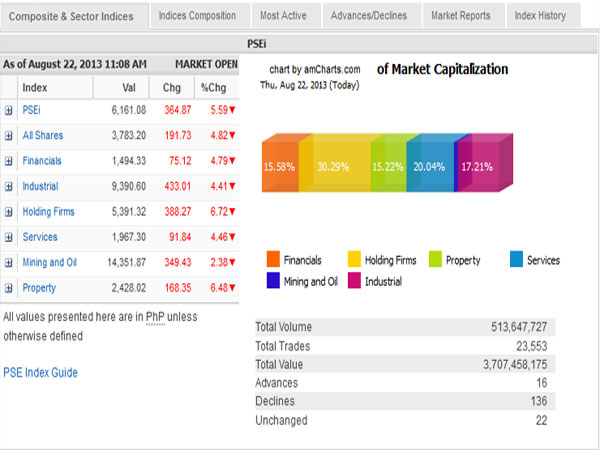

Philippine Stock Index, August 22, 2013. Screengrab from https://www.pse.com.ph/stockMarket/home.html

MANILA, Philippines — The local financial markets slumped on Thursday as international fund managers pulled funds out of emerging markets as the tapering of easy US money policy appeared imminent.

The main-share Philippine Stock Exchange index lost 389.22 points or 5.96 percent to close at 6,136.73 as investors scrambled to unload local blue chips, many of which have hit record-high valuations in earlier months.

The index slipped by as much as 7 percent in earlier trade, pricing in the gloomy sentiment on emerging markets that has bludgeoned regional markets in the last three days that local markets were shutdown by inclement weather and a national holiday.

Local bond yields also rose while the peso fell to as low as 44.17 against the US dollar in morning trade from Friday’s close of 43.64. Weighted average was at 44.087 while total value turnout at the spot foreign exchange market amounted to $749.5 million.

Across the region, fund managers were pulling investments out of emerging markets in anticipation of the withdrawal of massive liquidity from the US Federal Reserve.

The release of Federal Open Market Committee minutes Wednesday night affirmed the view of tapering the $85 billion monthly asset buying, also referred to as quantitative easing, but the Fed has yet to signal the exact timing. Many are pricing the tapering to begin by next month.

“It’s not an issue of if. It’s an issue of when,” Bank of the Philippine Islands president Cezar Consing said on the sidelines of the BPI-FinanceAsia 5th Annual Treasury and CFO Summit. He said this shakeout was a reminder to investors not to rely too much on liquidity to support asset prices.

In the aftermath of the Lehman Brothers’ collapse in 2008, Consing said, monetary regulators around the world, especially those in the major economies, were very much “in sync” in injecting additional liquidity to address a credit crunch. “The challenge now is withdrawal is not in sync, and that’s what makes markets volatile,” he said.

BPI executive vice president and treasurer Antonio Paner said the peso would trade at the 44 levels but recover to 43-ish levels against the US dollar by yearend, supported by strong macroeconomic fundamentals and resilient foreign exchange flows.

At the local stock market, the most heavily battered stock was SM Prime, which slid by 10.61 percent. AGI and AEV plunged by over 9 percent while SMIC, Megaworld, ALI and MPI all faltered by over 8 percent. Ayala Corp., BDO and Meralco slipped by over 6 percent.

“After three days closed, the market played catch up – or maybe catch down – with other markets in the region. Funds are flowing out of the region and into the US and European markets. Local investors should expect a wild ride in the coming sessions,” said PNB Securities deputy chief Manuel Lisbona.

Lisbona said the PSEi’s next support would be at 6,000 initially and if broken, might retest 5,800 or basically back to where the local index started for the year.

The PSEi was the most heavily battered Asian index as Thursday’s morning trade after as regional peers already took the brunt of the capital reversal in the last three days.

Originally posted at 11:13 am | Thursday, August 22, 2013