Philippine stocks tumble on US Fed tapering

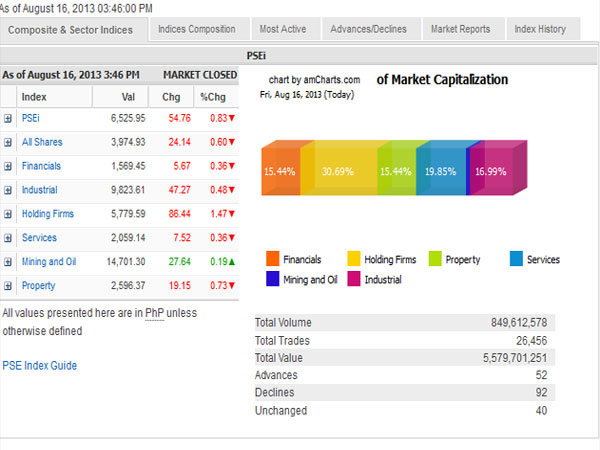

Philippine Stock Exchange index, August 16, 2013. Screengrab from https://www.pse.com.ph/stockMarket/home.html

MANILA, Philippines—Most local stock prices tumbled for the second straight session on Friday as jitters over the tapering of US Federal Reserve’s easy money policy intensified following better-than-expected US jobs data.

The main-share Philippine Stock Exchange slipped by 54.76 points or 0.83 percent to close at 6,525,95, tracking the bloodbath across regional markets.

For the week, the index was still a net gainer of 121.72 points or 1.9 percent.

Dealers said sentiment was affected by escalating jitters over US Fed tapering, which likewise caused an overnight slump on Wall Street. A surprise improvement in US jobless claims alongside rising inflation boosted expectations that the US Fed would indeed reduce its $85 billion monthly asset buying starting next month.

Turnover at the local market on Friday amounted to P5.58 billion. There were only 52 advancers versus 92 decliners while 40 stocks were unchanged.

Investors also continued to factor in global fund managers’ adjustment arising from the latest quarterly MSCI index review, which resulted in a 6.9 percentage cut on SM Investments’ weight to a pro-forma weight of about 8.72 percent. Overall, the Philippines’ weight on MSCI’s emerging market index was pared down to 0.95 percent from 1.02 percent effective September 2.

SM Investments (-1.18 percent), was the second most actively traded stock. “The reduction of MSCI weighting for SM has nothing to do with its business fundamentals. The fall in the share price is an opportunity to buy a growth stock at cheaper price levels,” said Jose Mari Lacson, head of research at Campos Lanuza & Co.

There were other index stocks that were more battered than SMIC. MPI and AEV fell by over 3 percent while RLC and JG Summit faltered by over 2 percent. Meralco, MWC, BPI and Jollibee also shed over 1 percent in their stock prices.

On the other hand, those that bucked the day’s downturn were Petron, Semirara, SMC, Belle, Metrobank and Ayala Corp.

As part of the MSCI realignment , there was an increase in the weight of Ayala Land Inc. by 1.05 percentage. The following companies will likewise see an upward weight adjustment in the MSCI Standard index: PLDT (+0.61%), BDO (+0.56%), ICTSI (+0.55%), SMPH (+0.51%), AC (+0.51%), URC (+0.50%), AEV (+0.45%), BPI (+0.31%) and AP (+0.29%).

On the MSCI Philippine small-caps index, there were weight increases for RCBC (+0.72%) and Vista Land (+0.05%).