PSE nets P429M in first half of 2013

MANILA, Philippines–The Philippine Stock Exchange hiked its first semester net profit by 31.8 percent year-on-year to P428.95 million as the local bourse collected higher fees related to trading, listing and clearing of equities.

Operating revenues rose by 36.97 percent to P712.69 million as trading- and listing- related income as well as service fees generated by wholly-owned Securities Clearing Corp. of the Philippines (SCCP) all increased by double-digit levels alongside the more robust capital markets.

On the other hand, the PSE’s expenses grew at a slower pace of 15 percent year-on-year to P237.14 million, bulk of which (43.66 percent) went to compensation and other related staff expenses.

On the revenue side, all business segments contributed to higher profitability in the first six months as follows:

Listing-related income climbed by 29.67 percent driven by fees from initial public offerings, additional listing of shares and listing maintenance;

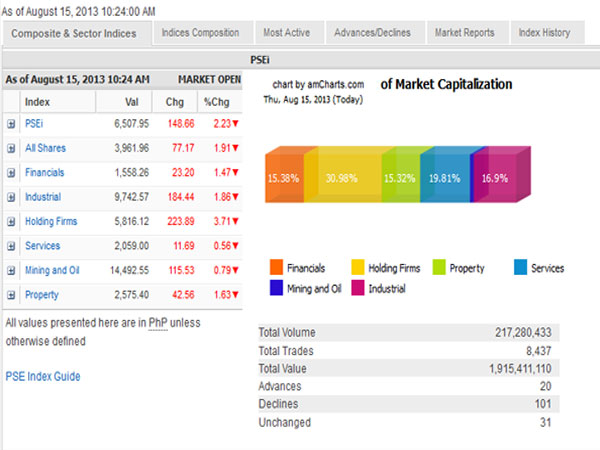

Trading-related income, inclusive of amount ceded to the Capital Market Integrity Corp. (CMIC) as regulatory fees, went up by 38.49 percent as daily turnover in the local bourse averaged higher at P11.51 billion from P7.64 billion last year; SCCP fees rose by 48.18 percent due to higher trading volume.

Listing-related income accounted for 38.63 percent of operating revenues or about P275.31 million while trading-related income had a share of 24.58 percent or P175.2 million. SCCP service fees accounted for 35.19 percent or P250.8 million.

On the other hand, other income fell by 11.26 percent to P76.93 million primarily due to the drop in the performance of equity funds managed by two external fund managers under a purely discretionary mandate. Interest earnings likewise dipped by 19.66 percent due to lower interest rates.