PH stocks rally anew on US retail data, SM property consolidation

MANILA, Philippines — Local stocks rallied for the third straight session on Wednesday, riding on better core US retail sales data and the SM property consolidation.

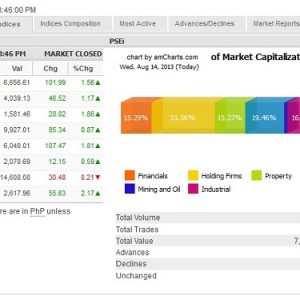

The main-share Philippine Stock Exchange index gained 101.99 points or 1.56 percent to close at 6,656.61 ahead of an expected MSCI rebalancing of equity indices.

Peter Raymond Lee, an analyst at IGC Securities, said the main index was still trading higher on the back of consolidation of SM property units.

SMIC, the day’s most actively traded stock, gained by 3.13 percent. Shares of SM property units SM Prime, SM Development Corp. and Highlands Prime valued at a total of P64 billion were crossed on the local stock exchange on Monday, resulting in the consolidation of ownership of SMDC and HP in SM Land, which will afterwards be merged with SM Prime, the surviving entity in the merger.

The day’s best performing index stock was Jollibee (+5.36 percent) on the back of favorable consumer play, followed by RLC, AGI and Metrobank which all gained by over 4 percent.

ALI, AEV, SMC, Bloomberry and MWC also contributed to the day’s PSEi gains.

Dealers said the PSEi was likewise being supported by the mostly favorable stream of second quarter earnings results.

Jonathan Ravelas, chief strategist at Banco de Oro Unibank, said the PSEi may try to test the 6,750 levels. “If broken, (this) puts the bulls back to play,” he said, adding that failure to breach this resistance, however, may signal a re-testing of the 6,350 support.

Value turnover at the local market amounted to P7.37 billion. There were 94 advancers that outnumbered 47 decliners while 42 stocks were unchanged.

The day’s index laggers were AP, FGEN, Semirara and Philex, which all declined by over 1 percent. EDC, DMCI, AC and PLDT also closed lower.

Across the region, trading was mostly upbeat in early trade as stronger than expected core US retail sales brought good tidings but sentiment ended mixed at close.

It was reported that US retail sales had risen by 0.2 percent in July, which was less than expected but “core” retail sales – which takes out cars, gasoline and building materials – posted its largest gain in seven months, rising by 0.5 percent. This core data was welcomed by analysts, being considered as the better gauge of consumer spending in the world’s largest economy. The data was widely read as an indication that the US economy was gaining ground.