Implications of a territorial dispute

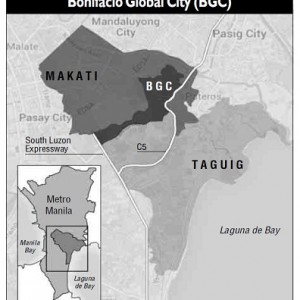

What are the implications in the tug-of-war between Makati, Taguig (and recently, Pateros) in their legal claim of the revenue-rich Bonifacio Global City-Fort Bonifacio area?

What are the implications in the tug-of-war between Makati, Taguig (and recently, Pateros) in their legal claim of the revenue-rich Bonifacio Global City-Fort Bonifacio area?

Real estate experts recently enumerated to Inquirer Property the five implications created by the continuing land dispute. The negatives are: growth curtailed, reduced confidence of tenants, confusion, and various interpretations of the decision.

However, there is also a positive implication whether the commercial properties are determined to be located in either Makati or Taguig. The cost of operations is lower if the business address is in Taguig, while real property taxes for commercial properties would be lower if they were in Makati’s jurisdiction.

Enrique M. Soriano III, Ateneo program director for real estate and senior adviser for Wong+Bernstein Business Advisory, said that major functions of government are to regulate, collect taxes, issue licenses and permit and deliver basic city services.

“When these functions are compromised because of territorial or boundary disputes, growth is also curtailed, and confidence of locators and businesses in BGC (numbering almost 100 operating vertical buildings and several retail and commercial developments) will wane.”

Reduced tenant confidence

Soriano said, “With an escalating tug-of-war, and it is likely this (case) will persist without any clear certainty for closure, and aggravated by the mixed and confusing pronouncements from the three mayors, we can expect BGC residents, tenants, locators and even future developers and investors to naturally waver, with their growth forecasts hanging.”

He added, “As we say in business, time is money, and if BGC (even if it’s our country’s showcase and newest CBD) will continue to be mired in a legal tug-of-war, businessmen will vote with their feet and run to the next competing CBD.”

In this scenario of conflicting claims, various interpretations of the decision would arise and affect the decisions of future locators in BGC.

Claro dG. Cordero Jr., Jones Lang LaSalle’s head for Research, Consulting and Valuation, said: “In light of the issue involving BGC, there is no foreseen direct implications on BGC residents and locators immediately, as the final takeover plans and details have yet to be laid out. Also, there are available legal remedies for both Taguig City and Makati City, which will aid in maintaining an orderly situation in BGC.

Confusion

“Over time, the only setback is the confusion and various interpretations of the decision which may affect the decision of future locators in BGC. Hence, the fastest that this case is resolved with finality, the most beneficial it would be for BGC locators and residents.

“Notwithstanding, we believe that both Taguig City and Makati City will arrive at an amicable resolution that will not tend to disrupt the business environment in Bonifacio Global City,” Cordero said.

Julius Guevara, Colliers International’s associate director for advisory services and head of consultancy and research, said the most-felt effect of the Makati-Taguig issue on Fort Bonifacio involves the cost of operating a business in the area.

“Locating a business in BGC or McKinley Hill presented cost savings for businesses since they could be located close to Makati while paying lower local taxes to Taguig,” Guevara said.

He explained that “business taxes for mayor’s permit renewal in Taguig are about a third of Makati business taxes, so this presents huge cost savings.”

“This will definitely affect businesses located in Fort Bonifacio for the tax advantage. On the other hand, businesses that are Peza (Philippine Economic Zone Authority)-accredited (such as BPOs) are exempt from local taxes, so this will not affect them significantly.”

“In terms of real property taxes for commercial properties, Makati’s tax is actually lower than Taguig’s (2 percent versus 3 percent of assessed value, including the special education fund tax),” Guevara said.

He added that “for residential properties, the tax is the same between Makati and Taguig.”