Japan firms spend record amounts in Southeast Asia

TOKYO—Japanese firms have spent record amounts scooping up assets in Southeast Asia this year, part of a trend that has seen Tokyo moving to boost its presence in the fast-growing region and away from China.

As Japan’s Prime Minister Shinzo Abe leaves Thursday for a three-day trip to some of the region’s biggest economies to tap an expanding middle class, figures show Japanese firms have already this year spend more on mergers and acquisitions than ever before.

Rising wages in China and a Tokyo-Beijing territorial dispute that has infected bilateral trade has also taken the sheen off the world’s number-two economy as an investment destination, analysts say.

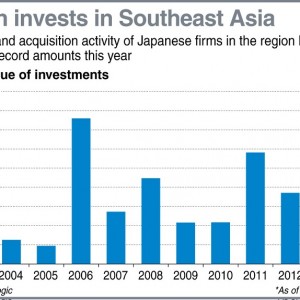

Japanese firms have spent a staggering $8.2 billion on M&A in Southeast Asia so far in 2013, already a record with five months to go and well above the $614 million at the same point in 2012, data provider Dealogic said.

The figure easily outstrips the previous full-year best of $7.6 billion in 2006, it added.

Two deals helped inflate this year’s figure: Mitsubishi UFJ’s $5.6 billion bid earlier this month for Thailand’s Bank of Ayudhya and Sumitomo Mitsui Banking Corp.’s agreement to buy a 40 percent stake in Indonesia’s PT Bank Tabungan Pensiunan Nasional for about $1.5 billion.

But Japan also took top spot in terms of the overall volume of such regional agreements, followed closely by Thai and Singaporean firms, said Dealogic, which counts deals in its data from the moment they are announced.

Searching for other investment areas

The Thai bank tie-up comes after Japan’s largest lender said it had agreed to buy a 20 percent stake in state-owned VietinBank for about $743 million, the largest-ever foreign investment in Vietnam’s banking sector.

Toyota has said a new $230 million plant in Indonesia will start producing vehicle engines by 2016, among a string of investments in the region by the world’s biggest automaker.

“Japanese companies have been searching for places to invest in addition to China,” said Toru Nishihama, economist at Dai-Ichi Life Research Institute. “This trend is likely to continue for the next five to ten years.”

The ramped-up shopping spree has come even as the yen has weakened against the dollar since late last year—owing to a big-spending plan by Abe to kickstart the economy—making overseas deals relatively more expensive for Japanese firms.

The 58-year-old premier’s three-day tour to Malaysia, Singapore and the Philippines is the latest of several trips he has made with business leaders since coming to power in December that aim to drum up new deals.

In May, Abe announced a development aid and loan package for Myanmar worth hundreds of millions of dollars as it boosts trade ties with the once-isolated nation, which has ushered in a raft of political reforms.

Japan also agreed to cancel about $1.8 billion of Myanmar’s debts during a visit by Abe. He was accompanied by a 40-strong delegation of bosses from some of Japan’s top companies.

“The Japanese government is very proactive about it,” Nishihama said. “It has become enticing for Japanese businesses to invest in Southeast Asia, with government-affiliated financial institutions.”

Tensions with S. Korea, China

Tokyo’s shift in focus comes amid tight diplomatic tensions with neighbors and key trade partners South Korea and China, where a jump in wages has pushed up foreign firms’ costs and made it a less appealing place to set up shop.

Relations have been frayed as Abe mused about watering down Japan’s apology over wartime aggression while territorial disputes also tested nerves.

Last year, a long-running row with China flared over an island chain in the East China Sea, setting off a consumer boycott of Japanese brands in China, a major export market.

Hundreds of Japanese firms also have plants in China, including major automakers such as Toyota and Nissan, and the dispute hurt firms’ view of the country.

Nissan chief Carlos Ghosn last year warned that the Japanese automaker—the most dependent on China among Japan’s big three—would think twice about investing more in the country, where it already has several plants.

“Certainly beyond what we have decided, before going for further decisions in China, we will be very careful in assessing how much of an impact (the political situation) has on consumers’ minds,” Nissan’s top executive told the Financial Times newspaper in October.—Hiroshi Hiyama